Most people prefer supplementing their income with investments. However, it is not easy to calculate how much time you would need to accumulate the corpus you aim to save by investing a certain amount every month. Precisely, this is where an investment calculator comes into play. While using an investment calculator, you need to provide some basic details, including your initial investment amount, how much you are planning to save and if there is any lump-sum amount you have. Then, the calculator will inform you of the time duration you would require to accumulate the corpus.

What is Value Research’s investment calculator?

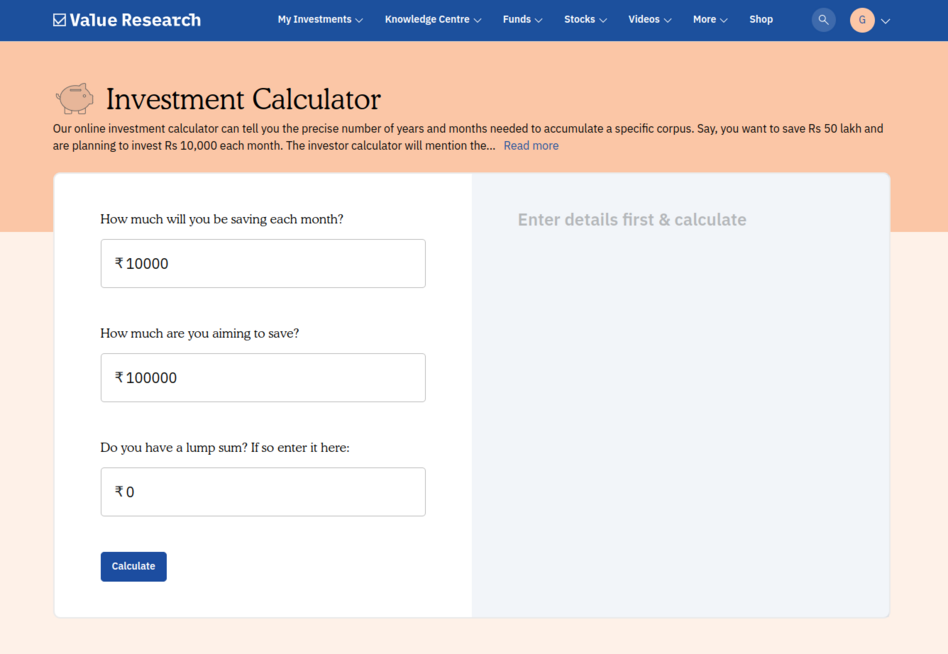

At Value Research, we offer an online investment calculator that can inform you of the months or years required to accumulate the corpus. For instance, if you want to save Rs 1 crore and for this, you are planning to invest Rs 10,000 every month. By using our investment calculator, you will be able to know the time you will require to meet your goal. While using our long-term investment calculator, you just need to submit some basic details, including your monthly savings, your targeted corpus, and the lump-sum amount, if any. Then, it calculates the time period required to build your desired corpus.

How to use the investment calculator of Value Research?

Using the investment calculator of Value Research is very easy. Here is a step-by-step guide for your convenience.

- To access our investment calculator, visit https://www.valueresearchonline.com/calculators/

- Click the ‘Investment Calculator’ button under the ‘Essential Tool’ tab.

- On the ‘Investment Calculator’ page, you need to submit all the necessary details.

- Once you submit all your details, click on the ‘Calculate’ tab. Our investment calculator is easy to use.

What are the benefits of using Value Research’s Investment Calculator?

Plan your investments better: If you are planning to accumulate a corpus by investing a certain amount, then you can use Value Research's investment calculator to know how much time you need to gather the amount. Ultimately, our investment calculator will help you plan your investments better and in line with your investment objectives.

Simple and easy to use: Our online investment calculator is easy and simple to use. Most importantly, you can put several data points until you can check a financial projection that goes with your financial goals.

Time-saving: Making financial calculations manually is a time-consuming activity. Our investment calculator helps in saving the time and effort required for all calculations.

Free of costs: The investment calculator provided by Value Research is available free of cost. You can use our investment calculator as many times as you need without paying anything.

Know more about investments - FAQs

With investments, you can keep your surplus money in a place where it can work for you. In other words, if you save some money from your income and use it in a financial vehicle that can generate income in the future, it will be known as an investment. Now when it comes to financial vehicles, there are several options available. If you are a conservative investor, then you may choose a fixed-income financial vehicle. In such vehicles, your principal amount will stay safe, and you will earn interest on this amount. However, if you are an aggressive investor and ready to take some risks, you can follow the equity route and earn higher returns.

What are the types of investments?

Bonds: A type of fixed-income instrument, bonds are issued by companies as well as governments to raise money for specific purposes. There are three types of bonds available. These include: treasury bonds, municipal bonds and corporate bonds.

Real Estate: Investing in real estate is another way to generate returns. You can purchase a house to stay in or get rental income from the place. Alternatively, you can purchase a piece of land and make necessary improvements to it.

Fixed deposits in banks: If your risk appetite is low, then you can think of investing in a fixed deposit (FD) in a bank. It is a good investment option, especially for people with a low-risk appetite.

Commodities: Commodities can signify any valuable metals, including silver and gold. If you invest your money in gold, then you can use it during different financial uncertainties.

Public Provident Fund: Public Provident Fund or the PPF is another good investment option. With this investment vehicle, you can enjoy tax benefits under Section 80C of the Income Tax Act. Besides, the interest that you can earn from this and maturity enjoy tax exemption.

National Pension Scheme: If you want to safeguard your golden years, you can invest in the National Pension Scheme or the NPS.

Debt mutual funds: These open-ended mutual funds are known for less volatility than equity mutual funds. With these funds, you can expect stable returns.

Fixed maturity plans: If your risk appetite is low, you can invest in a fixed deposit (FD). It is a promising investment avenue for people having a low-risk appetite.

Equity-oriented mutual fund scheme: As suggested by their name, these schemes invest at least 65 per cent of their corpus in equity.

Stocks: For institutions and individual investors, investing in stocks is quite popular. By investing in stocks, you will get a percentage of ownership of a company, and the company will share its profits with you.

What are the risks and returns associated with investments?

When it comes to investments, risks and returns are two important aspects that you should consider as an investor. Remember, the closer you go to retirement, the more vulnerable you will be as an investor. As suggested by financial advisors, you should reduce your exposure to risk when going closer to retirement by moving your investments to fixed income from equity.

In the world of investments, a trade-off lies between risks and returns. It means if the risk potential is high, then the return potential is high too. But it is also true that any safe investment vehicle is hardly able to beat inflation. Nevertheless, you should consider your age and risk appetite while choosing your investment vehicle.

How should you decide your risk appetite?

Risk appetite signifies the amount of risk that an investor is ready to take. Since various investment products come with several risks and returns profiles, you need to know your risk appetite before you make an investment. The following points will help you evaluate your risk appetite.

Your financial objectives: Assess your risk appetite based on your financial goal. For example, if you are investing for something that is very important to you or your family, then your risk appetite would be low.

Your investment horizon: If you are investing for the long term, then you should have a moderate risk appetite. Since your investing horizon is long, it is possible for you to take some calculated risks.

Age: Our age matters a lot when it comes to our risk appetite. People in their 20s and 30s are able to take more risks than those who are nearing retirement.

Your response to the market movement: You can determine your risk appetite by evaluating your response to the movements of the markets. If you are able to manage the highly volatile nature of the equity market, then your risk appetite is relatively high.

What are other calculators provided by Value Research?

Investment calculator: With Value Research's investment calculator, you can estimate how long should you save in order to reach your financial goal.

Goal Calculator: With our online goal calculator, you will be able to estimate how much you need to save every month to meet your goals. All you just need to do is to mention the amount you want to save and the lump-sum amount, if any, you have already saved for that particular goal.

Tax Calculator: With Value Research's online income tax calculator, you can easily estimate the total tax payable under the old or new tax regime.

SIP Calculator: Value Research’s SIP return calculator will help you estimate how much your SIP investments will accumulate over a period of time. You can use our SIP mutual fund return calculator for all types of mutual fund schemes.

Mutual Fund Calculator: With our mutual fund calculator, you can see the estimate of how much your monthly investment will grow in a particular mutual fund of your choice, over a period of time.

Glossary related to investment calculator

Investment goal: It refers to the goal(s) or the purpose(s) for which you are allocating money to various investment avenues, including mutual funds, stocks, and bonds.

Amount of initial investment: It is also called the principal amount. It refers to the amount that you will invest at the initial stage of your investment.

Years to accumulate: Also known as the length of your investment, it refers to the number of years that you will get to make investments for any particular goal.

Contribution frequency: It refers to the frequency that you will follow to make contributions to your investments.

Additional contribution: In financial terms, this is also called the annuity payment. Nevertheless, you can continue making investments without any additional contributions. But if you make additional contributions during your investment lifetime, it will pave the way for you to get better returns.

Rate of return on investment: It refers to the investment rate that you will anticipate from your investments. However, the kinds of investments you opt for will largely decide the actual rate of return that your investments will yield.

Compound interest: It refers to the interest applied to your investment's interest, in addition to your previous interest. With an increase in its frequency, you will be able to get additional interest on your accumulated interest.

Stock calculator: Also known as share-average calculator, stock calculators will help you calculate the average cost per share of each stock available in your portfolio. With a stock calculator, you can determine the number of shares that you need to average up or down in any specific stock.

Index fund calculator: If you invest in an index fund, you can opt for this online tool to get an estimate of the returns on your investments. Leveraging this calculator, you can also compare various SIP plans. It will help you go smart with your SIP investments.

See Less