If you had a nickel for every time someone said that hybrids are the future, you'd be a millionaire. But it's not the sleek, fuel-efficient hybrid EVs we are talking about. We are referring to hybrid funds.

These are mutual funds that invest in different asset classes (equity, debt, real estate, gold, among others), making them an attractive option for new investors.

By diversifying across asset classes, hybrid funds offer stability. That's because each asset class usually performs differently under different market conditions. For example, during economic booms, equities thrive, while in downturns, debt investments take precedence, with equities taking a backseat.

What's more, hybrid funds can be an excellent springboard for new investors. Since they offer a balance between risk and return, it helps us, the new investors, take our time to build confidence in the investment world. Eventually, it trains us to plunge into equity, as it is the best asset class for building wealth in the long run. (Watch video: Why equity is better than other asset classes in the long run)

Given the benefits of hybrid funds, let us not waste away our annual bonus this time. While keeping up with the Joneses, or living beyond your means to match your friend's lifestyle, can be thrilling, it ends up with us calling our parents for financial help at the end of the month.

So, let's spare another round of embarrassment and get money smart.

Understanding the world of hybrid funds

There are several types of hybrid funds, such as balanced funds, balanced advantage funds, multi-asset allocation funds and aggressive hybrid funds.

But let's not overcomplicate our lives and instead spotlight the latter two: multi-asset funds and aggressive hybrid funds.

Multi-asset allocation funds spread investments across three or more asset classes, with at least 10 per cent of the money invested in each of them. Typically, the asset class ranges from equity and debt to gold and real estate.

Meanwhile, aggressive hybrid funds invest up to 65- 80 per cent in equities and 20-35 per cent in debt.

Performance

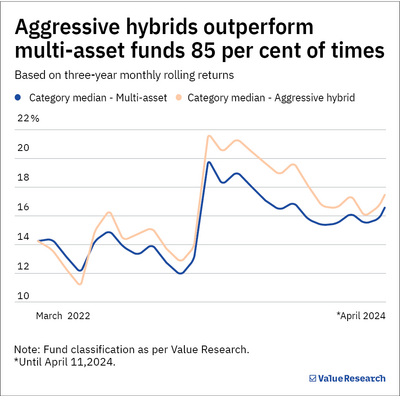

Aggressive hybrids are distinctly better on this front. They have consistently outperformed the average multi-asset funds over three years, albeit by taking slightly higher risk.

The outperformance is due to aggressive hybrids investing more in equity, a high risk-reward asset class, in the last five financial years: roughly 70 per cent compared to multi-asset funds' around 50 per cent.

However, aggressive hybrids have also remained resilient during market stress, thanks to their debt allocation.

Their stability is evident in the numbers. Whenever the broader market has fallen since March 2019, 25 of the 45 aggressive hybrids have outperformed the broader market index (BSE 500 TRI) a whopping 75 per cent of the time.

In fact, these funds outperform even multi-asset funds, which appear safer based on their asset diversification.

Another exceptional stat is that during the March mayhem of 2020, all aggressive hybrids, barring one, fell less than the market.

Tax treatment

Aggressive hybrid funds come out on top here, too. They are treated as equity-oriented funds, where long-term capital gains tax is just 10 per cent.

Suggested read: How equity funds are taxed?

The same cannot be said for all multi-asset funds. Tax treatment for multi-asset allocation funds varies based on their last 12-month average equity allocation. If they have over 65 per cent equity allocation, they enjoy similar tax benefits to aggressive hybrids.

However, a lower allocation forces investors of these funds to cough out a higher tax amount.

Our take

It is clear that aggressive hybrids are a more compelling choice for a first-time investor.

They have historically performed better and have a more defined asset allocation structure, which offers a more optimal risk-reward tradeoff than multi-asset funds.

Last but not least, some multi-asset allocation funds invest in gold, which, in our opinion, can be a hedge against inflation but not an ideal option for building wealth in the long run — at least not for a first-time investor who is building their wealth from scratch.

Also read: Aggressive hybrid vs balanced advantage funds: Which one to choose?