AI-generated image

AI-generated image

Infrastructure is easily becoming the most sought-out sector among investors thanks to the massive sums of money it is receiving from the government kitty. Take for instance, the tripling of India's capex budget for infra spending in the last four years to Rs 10 lakh crore for FY24. Impressive, right?

The prospects are promising and the sector is teeming with companies. But only a select few tend to thrive amid intense price-based competition. This is even more true in case of small players, which easily flood the industry.

Admittedly, trying to discover any hidden gems in the sector is like finding a needle in a haystack. Hence, we applied some strict filters to find companies with robust earnings growth, superior quality and reasonable valuation. We looked for companies with:

- 5-year revenue and EPS growth > 10 per cent

- ROCE consistently > 20 per cent in last five years

- Debt to equity < 0.5

- P/E-to-Median P/E < 1.5

- Stock Rating of at least four

Our criteria returned only one player: PSP Projects.

The journey spanning over a decade

PSP Projects' origin goes back to 2008 when it was founded in Gujarat with an initial capital of just Rs 2 lakh. Cut to present, it is now bagging construction orders worth thousands of crore across industrial, institutional, government and residential projects.

Its first big milestone came in 2011 when it secured a Rs 130 crore-contract from the Zydus Group for a medical college and hospital. This was significant as its largest project until then was worth only Rs 15 crore. The Zydus project was not only delivered before time but it also met the quality expectations, leading to 29 more projects being awarded by the same client.

However, it was the Rs 1,575 crore-construction project of the Surat Diamond Bourse (SDB), the world's largest office building, which became a game-changer for the small-cap firm.

PSP Projects' proposal to break down the construction of SDB into three sub-projects, each with its own product manager and weekly site visits by company's founder Prahaladbhai Patel impressed the client. The company was then given approval to bid for the project, which it eventually won despite intense bidding from other giants. This project also paved the way to bid for projects up to Rs 2,500 crore.

Since then, it has continued to attract large and prestigious orders even from the government. In 2022, it secured a contract of Rs 1,344 crore to construct the Surat Municipal Corporation building, India's tallest government office. Over the last few years, it has steadily increased its exposure to government projects.

What has worked in its favour?

- Solid financials: The company boasts an impressive long-term financial track record. Its revenue and net profit have grown at 25 per cent and 30 per cent CAGR, respectively, over the last 10 years.

- Geographic expansion: The company has been focusing on expanding business beyond Gujarat to enhance its scale. Since 2016, it has forayed into six more states. It completed its first project in Uttar Pradesh (UP) in 2020 with nine more key projects under works by the end of FY23.

- Focus on efficiency: Maintaining efficiency has been a priority for the company. In 2011, it implemented the ERP (enterprise resource planning) software, which was quite unusual at the time for a small construction player with earnings below Rs 10 crore. A concentrated order book in a few geographies further allows it to utilise its assets better, unlike larger peers with wider presence.

- Short-term projects: Unlike roads or highways, PSP's projects are generally not long-term in nature. This leads to early cash conversion, a shorter working capital cycle and low capital requirements for the company.

What's worrying the Street?

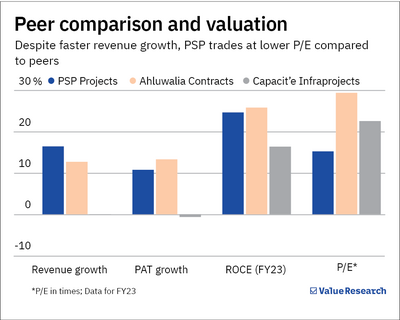

- Behind peers on revenue conversion: The company's order book-to-revenue ratio as of FY23 was 2.6 times compared to 2.9 and 5.3 times, respectively, for peers like Capacit'e Infra and Ahluwalia Contracts. This was owing to its execution of mostly short-term projects, which are not awarded in advance. A lower order book-to-revenue ratio indicates lower revenue visibility against competitors. This is perhaps why the stock is cheaply valued than peers (P/E of 15.3 times) despite its faster revenue growth and superior return on capital employed (ROCE).

- Poor cash flows: Over the last three years, the company's cash flows have been another sore point. Delayed payments from the SDB project and high working capital requirements in UP projects have resulted in poor cash conversion, prompting it to raise short-term debt. As a result, its finance costs have significantly increased in the last two years, denting profitability.

Our view

The company's projects in UP are nearing completion. Hence, an improvement in cash flows and margins are possible, which can help it reduce its debt burden. Notwithstanding these short-term pressures, we believe a steady order flow will likely help the company sustain its historical growth rates.

That being said, the above-mentioned risk factors should not be ignored. This is not a stock recommendation and investors should do their own due diligence.

Also read : Voltas: Does it deserve a spot in your portfolio?