AI-generated image

AI-generated image

How are aggressive hybrid funds advantageous over pure equity funds? - Anonymous

You can't directly compare equity and aggressive hybrid funds. It's like comparing potatoes and pineapples. Both funds are very different. Pure equity funds invest predominantly in equities, while aggressive hybrids allocate 65-80 per cent to equities and the rest to debt. The equity allocation offers the potential for higher returns, while the debt allocation provides relative safety. That's why these funds are ideal for beginners or conservative investors.

Still, if you must compare aggressive hybrids with equity funds, here are a few advantages of the former over the latter.

1) Downside protection

Due to their decent debt allocation, aggressive hybrid funds provide a much-needed cushion during turbulent times. They fall less than pure equity funds, which ensures investors, especially first-time and conservative investors, don't exit the market in fear.

The numbers back up aggressive hybrids' resilience during a market slump. In the five worst market falls in a calendar month over the last decade, aggressive hybrid funds have fared better than flexi-cap funds (a type of pure equity fund) and the broader market index (S&P BSE Sensex).

2) Good returns over the long term

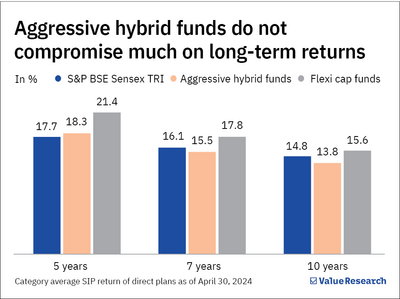

Despite having 20 to 35 per cent of its money in debt, a 10-year SIP in an average aggressive hybrid fund would have returned 13.77 per cent, which is only slightly less than S&P BSE Sensex's 14.80 per cent and flexi-cap funds' 15.63 per cent, respectively, over the same period.

3) Tax-efficient rebalancing

Rebalancing involves selling and buying mutual fund units to maintain a desired asset allocation. Selling mutual fund units incurs capital gains tax.

If you hold separate equity and debt funds and sell any of them for rebalancing purposes, you must pay taxes on the realised gains.

However, hybrid funds automatically rebalance their portfolios at regular intervals, which exempts investors from capital gains tax while rebalancing.

Also read:

Aggressive hybrid funds v/s multi-asset funds

Aggressive hybrid funds v/s balanced advantage funds