AI-generated image

AI-generated image

Although an infant, it was already a bit different from the rest. Unlike the others, it offered an additional Rs 50,000 tax deduction. Unlike the others, it ensured your retirement planning had an equity component, which is crucial, as you'll find out later. And unlike the others, it has the potential to help you build a more sizable retirement corpus. Again, more on that later.

It was only in 2009 that a majority of Indian investors could set their eyes on the National Pension Scheme (NPS). Though open for subscription to government employees in 2004, the NPS opened its doors to the general public five years later.

Until then, the Public Provident Fund (PPF) and Employees' Provident Fund (EPF) ruled the retirement-planning roost. Sure, there were other options, but they were the OGs in this arena.

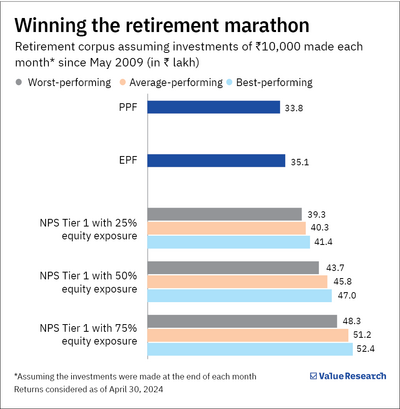

Fast-forward to 2024, the NPS is celebrating its 15th year. During this time, it has broken the duopoly of the PPF and EPF. In the last decade, the teenager has built a subscriber base of 35 lakh. And for good reasons, too. It partially invests in equity; NPS Tier 1 allows 25 per cent, 50 per cent and 75 per cent equity allocation options to its subscribers. As a result, it comfortably outstrips the two veterans in terms of performance. At least over the last 15 years, even the worst-performing NPS fund with the most conservative allocation of 25 per cent would have beaten PPF and EPF by 16.3 and 11.9 per cent, respectively. See graph titled 'Winning the retirement marathon'.

Reasons for NPS's outperformance

Its equity exposure. The other two are primarily debt-based instruments, which announce fixed rates of interest at specific periods. The strategic equity allocation in NPS turbocharges the growth of the retirement corpus over the long haul. For the uninitiated, risk associated with equity reduces in the long run, which is why retirement planners of all ages and risk profiles should have an equity component in their retirement investments.

On top of its impressive long-term returns, the NPS offers two distinct advantages that further cement its position as a compelling retirement investment option:

- Additional tax benefits: As mentioned earlier, investors can claim an extra tax deduction of up to Rs 50,000 under Section 80 CCD (1B). This is over and above the Rs 1.5 lakh tax deduction that's already available with PPF and EPF.

- Automatic rebalancing: The NPS offers a unique feature of tax-free automatic portfolio rebalancing on birthdays. This ensures that your asset allocation remains within your predefined limits. What's more, buying and selling independent equity and debt investments levy certain taxes, but not in their case.

Are there any downsides to the NPS? It's their withdrawal policy that mandates 40 per cent of the corpus to be used to buy an annuity plan for regular income during retirement. The remaining 60 per cent can be withdrawn lump sum or in a phased manner, upon retirement.

All said, the strict withdrawal policy is a blessing in disguise for many investors, especially those who are generous with their money and lack discipline. Ultimately, it will help subscribers amass a considerable warchest for their sunset years.

Our take

When it comes to retirement planning, there's only one winner: N - P - S.

Also read: A comprehensive guide on the NPS