AI-generated image

AI-generated image

Siemens, the Indian subsidiary of Germany-based tech giant Siemens AG, plans to demerge its energy business into a new entity called Siemens Energy India. This business segment, which provides power transmission solutions to sectors such as oil & gas, railways, and construction, will be separately listed on stock exchanges.

Shareholding and listing details

Under the proposed arrangement, Siemens' original shareholding structure will be maintained. Siemens' shareholders will receive one share of Siemens Energy for each share they currently hold. After the demerger, the promoters will retain a 75 per cent stake, while public shareholders will hold the remaining 25 per cent. The process, subject to regulatory approvals, is expected to be completed by 2025.

The rationale behind the demerger

This move mirrors a strategy previously executed by Siemens AG in Germany, which spun off its global energy business after it accumulated a net loss of around 7,179 million euros between 2020-2023.

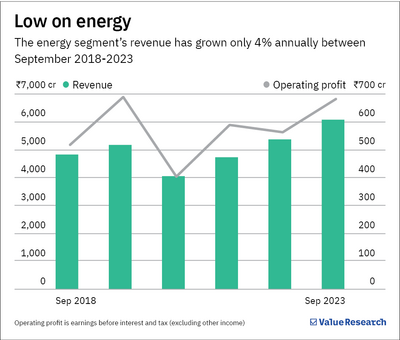

While the India energy business, contributing around 34 per cent to FY23 revenue, is profitable, its revenue has grown just 4 per cent annually between FY19-23. This was after the company spent around on an average 25 per cent of its total capex (excluding unallocated amount) between FY18-23 on the segment.

The segment has recovered in the last two years, with revenue growing 13 per cent annually. However, the management believes the underlying market drivers and capital allocation requirements are fundamentally different in the energy business than in the industrial business. It is optimistic that this structural separation will enhance decision-making efficiency, particularly in terms of capital allocation.

Also read: Is it the right time to invest in energy-sector mutual funds?