AI-generated image

AI-generated image

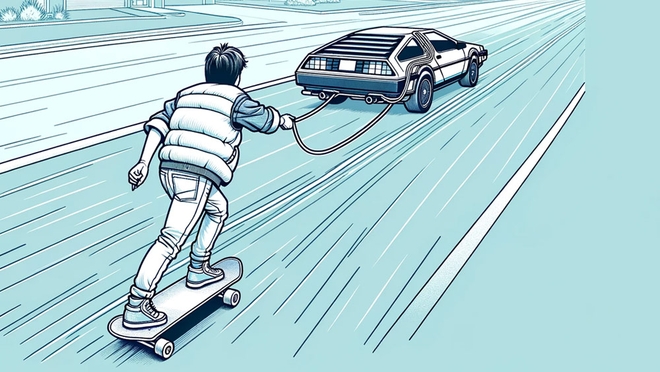

What do you do when a promising stock becomes expensive? Typically, you have to wait until the euphoria dies down. However, in the case of SRF, there might be a way to circumvent the high valuations.

The curious case of SRF and Kama Holdings

SRF, one of India's largest chemical manufacturers, has shown impressive growth. Over the past five years (as of the 12 months ending December 2023), its revenue has grown by 14 per cent annually, and profit after tax has soared by around 18 per cent annually. The market rewarded this performance, with its share price compounding by approximately 36 per cent annually over the same period. Based on these growth figures, an investment in SRF seems like a no-brainer. However, at a sky-high price-to-earnings (P/E) ratio of 50 times, it trades significantly higher than its five-year median P/E ratio.

Investing in SRF at these valuations is risky. However, there is a way to benefit from SRF's growth indirectly: through Kama Holdings, SRF's holding company. Kama owns about 50 per cent of SRF and has itself provided impressive returns, compounding at around 21 per cent annually over the last five years.

How you can gain from SRF's growth by investing in Kama

- Dividends. Kama Holdings consistently pays dividends, distributing nearly all its earnings. With a dividend yield of 1.4 per cent (adjusted for bonus issue), Kama shareholders can expect hefty dividends as SRF's earnings compound.

- A unique value play. Kama's standalone price-to-book (P/B) value is around 12 times. Simply put, the market values the company 12 times higher than the present value of all its assets, including its 50 per cent stake in its SRF. But here's the punchline. Kama's book value is calculated based on what it paid to acquire its stake in SRF. However, SRF's value has appreciated over the years. If you calculate Kama's P/B based on the present market value of SRF, the number drops to 0.2 times. In simple terms, it means that Kama's stake in SRF is available at an 80 per cent discount.

- Harmony in returns. Historically, whenever Kama's stake in SRF has traded at a hefty discount (as is the case presently), Kama has outperformed SRF in share price growth. A case in point would be the rally between 2015-2020. In March 2015, Kama's stake in SRF was trading at an 80 per cent discount. In the next five years, while SRF gave an annual return of 23 per cent, Kama's share price grew a whopping 34 per cent annually. However, note that the reverse also happened when the discount was low. In March 2019, Kama's stake in SRF was available at a discount of 49 per cent. In the next five years, Kama's share price compounded 25 per cent annually, while SRF returned 46 per cent annually in the same period.

But wait! Don't rush to invest just yet. Despite the aforementioned benefits, there are several risks.

The risks of investing in Kama Holdings

- Dependence on SRF: Kama's earnings are solely dependent on SRF's financial performance. Any consistent decline in SRF's earnings would severely impact Kama.

- Stake dilution: You can only gain from SRF's growth if Kama holds a majority stake in the company. Hence, any significant stake dilution is not just a threat but a potential disaster. Kama has not disclosed any plans to divest from SRF yet. However, in the last four years, its holdings have fallen to 50.3 per cent from 52.3 per cent.

- A decline in dividends: Kama has paid dividends regularly in the past. But, dividend payout might be impacted if Kama pursues new ventures.

Conclusion

Kama Holdings offers a unique proposition. It allows you to ride SRF's growth wave without investing at high valuations. However, the risks should not be ignored.

Also, note that the purpose of the article is to spotlight the interesting relationship between SRF and Kama Holdings. We have not explored these companies or the industry in detail. Do the due diligence before investing.

Also read:

How to invest like Raamdeo Agrawal?

The book value myth