AI-generated image

AI-generated image

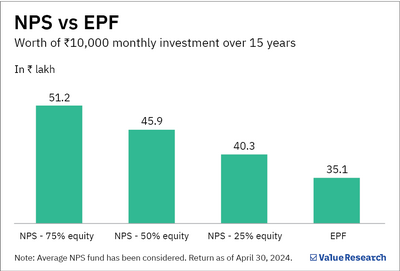

We recently wrote a piece on why the National Pension Scheme (NPS) should be the number one choice for retirement planning, as it can build a far more substantial corpus than the Employees' Provident Fund (EPF).

To recap, assuming a monthly Rs 10,000 investment since May 2009, an EPF would have helped you stack Rs 35.1 lakh. In contrast, an average NPS would have amassed between Rs 40.3 lakh (if you opted for a 25 per cent equity allocation) and Rs 51.2 lakh (75 per cent equity allocation). In other words, the NPS would have helped you build around 15 to 46 per cent more money for retirement. Now, that's a significant difference.

We even compared it directly with the PPF (Public Provident Fund) in the same story, and here's what we found.

More than a wealth builder

The goodness of NPS doesn't stop here. It can help you reduce your taxes by a higher amount than EPF.

Subscribing to the NPS can get you an additional deduction of Rs 50,000 in your taxable income. This is over and above the Rs 1.5 lakh deduction you already enjoy with both EPF and NPS. (As an aside, while this is not necessarily an NPS advantage, you should know that some companies have a policy of contributing up to 10 per cent of your basic salary. Their contribution is also eligible for tax deduction.)

Second, you can decide your fund manager and asset allocation in your NPS journey. Unlike EPF, you can invest as much as 75 per cent of your money in equity, which is good because this asset class can deliver higher returns in the long run.

Third, you can continue your NPS account with a minimum contribution of Rs 1,000 in a financial year, whereas your contribution to EPF would be 12 per cent of your basic salary.

What you should do

For new employees

Is your basic salary more than Rs 15,000 each month? If so, take the necessary permission from your employer that you want to start an NPS subscription instead of EPF. Anyone with a basic salary of more than Rs 15,000 has the option to not choose EPF.

However, some companies don't follow this rule. If they have 20 employees or more, they make EPF mandatory for everyone. In that case, if your company policy allows, we suggest you contribute the minimum amount of Rs 1,800 to EPF and the remainder in NPS (75 per cent equity). This will ensure your retirement pot grows at a brisker pace than EPF.

Those who already have an existing EPF account

There are two options here. The first is to start the NPS subscription along with the EPF account.

The second is to transfer the provident fund money to NPS.

But this is where it gets murky. Although PFRDA, the NPS regulator, outlined the employee-friendly steps for transferring the funds in a March 2017 circular, its implementation is apparently stuck in the crosshairs of bureaucracy.

We also tried reaching out to the EPFO but are yet to receive a response. We'll update you if or when we hear back from them.

Since the second option seems impractical at this point, our simple advice would be to simultaneously contribute to the NPS and maximise your retirement corpus, until there is more clarity.

Also read: