AI-generated image

AI-generated image

You might have spotted companies with punchy-double digit growth rates of 10, 20 or even 50 per cent in a year or two. But how often do you come across a company growing 10 times?! It is not a common sight, but Swan Energy has done it.

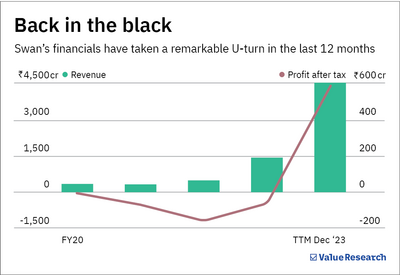

The company, which has a diversified presence across textiles, real estate and oil & gas segments, among others, reported a 10x revenue growth between FY22 and the 12 months ending December 2023. It also posted a net profit in the last 12 months (ending December 2023) after back-to-back losses in the previous four years. This dramatic turnaround is reflected in its share price performance, which shot up nearly three times in the last one year.

What led to a change in the company's fortunes? Let's find out.

The forces behind the turnaround

#1 The Veritas factor. The wind beneath Swan Energy's wings came from acquiring Veritas India, a chemicals, paper, polymer and rubber distributor, in FY23. It acquired a 55 per cent stake in Veritas for Rs 172 crore to use its distribution network to expand into the oil & gas space. Veritas' historical performance underscores why Swan Energy chose to invest in it. The company has managed to grow its net profit over 15 times in the past 14 years while keeping its price-to-book ratio below one for most of this period. In the last 12 months, most of Swan Energy's revenue came from Veritas. The market is optimistic that this promising acquisition will continue to boost Swan Energy's topline in the coming years.

A dirt-cheap bargain

Reliance Naval significantly outpaces its competitors in terms of capacity

| Reliance Naval | Cochin Shipyard | Garden Reach Shipbuilders | Mazagon Dock | |

|---|---|---|---|---|

| Dead weight tonne capacity (tonnes) | 4,00,000 | 1,25,000 | 26,000 | 30,000 |

| Plant and equipment (Rs cr) | 1,999 | 2,545 | 537 | 839 |

| Market cap (Rs cr) | 2,044* | 35,916 | 11,815 | 52,200 |

|

*The price paid by Hazen Infra (JV between Swan Energy and Hazel Mercantile) to acquire Reliance Naval Plant and equipment includes capital work in progress |

||||

#2 The defence sector boom. Swan Energy's recent foray into the defence and shipbuilding business has added to the stock's strength. It recently won the bid to acquire bankrupt Reliance Naval, India's largest shipbuilding dock, for Rs 2,000 crore, aiming to ride the government's spending spree in the defence sector.

#3 Capacity expansions. Swan Energy's expansion plans have also won it the market's favour. It plans to consolidate its position in the oil and gas space by constructing an LNG green terminal. This terminal is expected to have a regasification capacity of 5 MMTPA (million metric tonnes per annum). It will utilise an FSRU (Floating Storage Regasification Unit) for LNG receipt, storage, regasification and send-out.

Despite these positives, there are doubts as to whether Swan Energy can sustain this momentum, especially when Veritas' recent financials raise glaring red flags.

Alarm bells in Veritas' books

-

Its books smell fishy.

The company's principal auditor did not audit about 80 per cent of its FY23 revenue.

-

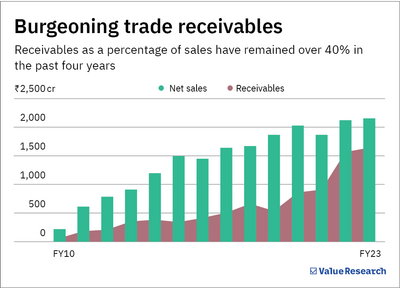

High trade receivables.

Its net trade receivables in FY23 were a staggering Rs 803 crore, which equals its cumulative profits over the last 15 years (FY08-23).

- Lacklustre cash generation. Despite accumulating a net profit of Rs 800 crore over 15 years, it has generated only Rs 35 crore in net cash in the last decade. In fact, its cash flows would be negative if it weren't for the trade payables, mostly due towards related parties. For instance, almost 50 per cent of its payables belonged to a related party, Hazel Mercantile, in FY19. Its low dividend payout further backs the poor cash flow situation. In the last 10 years, it has paid a dividend of just Rs 1.3 crore on an accumulated net profit of Rs 753 crore (FY14-23).

Our take

Swan Energy pulled itself out from a loss-making slump thanks to the crutch support from Veritas. However, it will be difficult for the company to replicate last year's multifold growth amid a receding base effect and Veritas' financial troubles. Moreover, Swan Energy's multiple acquisitions have led to a mounting debt load of Rs 5,148 crore as of September 2023, up from Rs 1,175 crore in FY20. However, it lessened the debt burden by raising Rs 3,000 crore via a QIP in February this year.

Apart from a stretched balance sheet, there are other risk factors. Its success in the newly ventured shipbuilding sector depends on government spending, given the industry is highly cyclical. The much-awaited LNG terminal has been in the works since 2016 and has faced multiple delays due to cyclones, highlighting the uncertainty of its completion. Lastly, the stock's high P/E multiple of 69 times also works against it.

Note that this is not a stock recommendation. Investors must do their due diligence before making an investment decision.

Also read: This pharma bluechip is springing back to life. Is it worth your consideration?