AI-generated image

AI-generated image

A good start is half the battle won. It's the same with the National Pension Scheme (NPS), an investment that helps you build wealth for retirement. When subscribing to the NPS, you are offered two investment options: Auto or Active. So, which one should you choose? Which is the right option that'll help you build more wealth in the long run? Let's deep dive and understand which option to choose.

Auto choice

What it is

Before discussing auto choice, you should know that the NPS broadly requires you to put your money across two asset classes: Equity and debt. (The debt portion is further divided into corporate bonds and government bonds. Then, there's alternate investment, too). But for simplicity, let's assume you put your money in equity and debt.

Under the auto choice, your money is automatically allocated to equity and debt based on age. Each year, the NPS reduces your equity exposure and allocates more money in debt.

This choice is usually opted by people who find it troublesome to decide when and how much to invest in each asset class and also those who are unaware that there is an Auto and Active option available to them.

Types of Auto choice

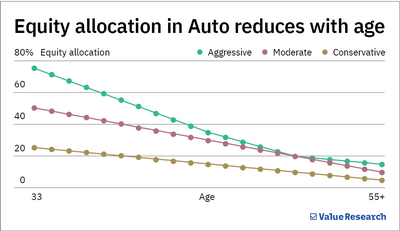

- LC75 (Aggressive Life Cycle Fund): Here, 75 per cent of your money is invested in equities until 35. Once you cross that age, the equity exposure reduces, and more money is invested in debt with each passing birthday. So, by the time you are 55, your equity allocation will decline to 15 per cent.

- LC50 (Moderate Life Cycle Fund): This is the default option in Auto choice. In this case, your investments are split equally between equity and debt until 35. After that, your equity exposure reduces every year. By 55, your equity allocation would be just 10 per cent; the rest of the money would be invested in debt.

- LC25 (Conservative Life Cycle Fund): The equity exposure starts at 25 per cent until 35 years and gradually reduces with age.

Active choice

What it is

In this case, you have the freedom to decide the equity-debt allocation.

However, you can only invest up to 75 per cent of your money in equity. There is no such restriction with debt; you can put 100 per cent of your money in this asset class.

What you should know

Your investments are rebalanced every year on your birthday. In simple words, let's say you invest 75 per cent in stocks and the rest 25 per cent in bonds. Over time, if your stocks grow faster and become 85 per cent of your total investments, then on your birthday, the NPS will sell some of your stocks and buy more bonds to return your investment to the original 75-25 equity-debt allocation.

Performance: Auto vs Active

Active has done better in the long run. The figure on the right shows that had you invested Rs 10,000 in NPS each month for 15 years, the Active choice (75 per cent equity) would have topped Rs 50 lakh today, whereas the LC50 (Moderate Life Cycle Fund), the default Auto option, would have Rs 7 lakh less. That's mainly because the latter option reduces the equity allocation with age.

What you should do

Opt for the Active choice. Its 15-year performance suggests so.

For instance, if you are in your 20s and 30s, it's best to opt for the Active choice and keep an equity allocation of 75 per cent. This thumb rule applies to a conservative investor, too, as the risk associated with equity has historically flattened over long periods. And since you'll have more than two decades of time horizon, equity should help you amass a larger retirement nest egg.

Meanwhile, if and when you are 4-5 years away from retirement, we suggest you reduce your equity exposure and lean more towards debt. That's because equity can be volatile over the short- to medium term.

In short, the Active route works for all scenarios.

Also read: Is NPS Tier II better than mutual funds?