AI-generated image

AI-generated image

While Quant AMC may have been tripped by front-running allegations yesterday (June 23, 2024), it has been a one-of-a-kind fund house because it learned to crawl, walk, and run in no time. Here are a few interesting numbers that showcase the fund house's blistering pace of growth in the last few years.

(Read more: What is front-running and how it impacts investors' gains )

1. Unprecedented growth

Quant Mutual Fund's growth since 2018 is nothing short of astronomical. Its total assets (assets under management) have grown nearly 800 times since December 2018. Today, it commands nearly 1.5 per cent of the mutual fund industry's assets.

2. Performance kings

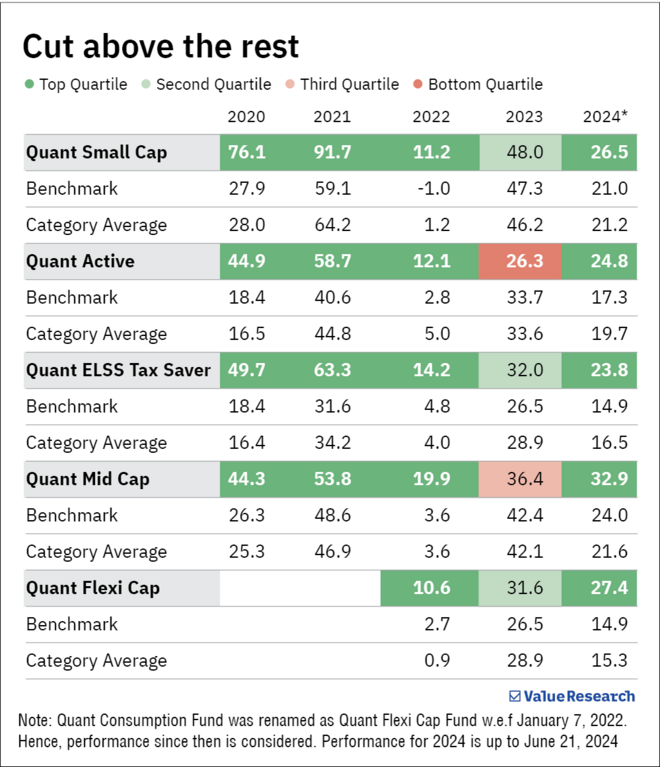

Regarding performance, 2023 looks like an anomaly in their otherwise impeccable track record of always being in the top quartile. Forget being in the top 25 per cent of performers, if you look at the table below, you'll notice these funds beating their benchmarks and peers by a thumping margin.

That said, Quant funds' experience significant volatility, as shown in the table below.

For Quant, high risk begets high reward

Data for last five years, unless mentioned

| Fund standard deviation (%) | Average peer's standard deviation (%) | Fund alpha (%) | Average peer's alpha (%) | |

|---|---|---|---|---|

| Quant Small Cap | 27.1 | 22.7 | 14.5 | 6 |

| Quant Active (Since Jan 2021) | 16.3 | 13.5 | 9.9 | 5.4 |

| Quant ELSS Tax Saver | 21.4 | 18.4 | 13.4 | 0.8 |

| Quant Mid Cap | 20.6 | 20.5 | 10.1 | 0.6 |

| Quant Flexi Cap (Since Jan 2022) | 16.9 | 12.9 | 8.4 | 0.4 |

3. Quant's pocket-sized dynamite

Their most popular fund is the small-cap fund, with Rs 21,243 crore total assets. Its growing size is a testament to its performance and the innate ability to pick small-cap stocks. Here are the 10 largest small-cap holdings of the AMC as of May 2024 disclosure, and the stellar stock performance since they bought them.

10 largest small-cap holdings

Interestingly, only three stocks in the list have been held for nearly three years

| Company | Purchased in | Value of investment (₹ crore) | Absolute returns (%) |

|---|---|---|---|

| IRB Infrastructure Developers | Aug-21 | 1,285 | 300% |

| Housing & Urban Development Corporation | Dec -23 | 1,271 | 117% |

| Aegis Logistics | Feb -22 | 1,152 | 319% |

| HFCL | May -21 | 959 | 129% |

| National Aluminium Company | Dec -23 | 898 | 45% |

| Aditya Birla Fashion and Retail | Apr -24 | 895 | 9% |

| RBL Bank | Aug-23 | 697 | 3% |

| Swan Energy | Oct -23 | 687 | 49% |

| Bikaji Foods International | Nov -22 | 668 | 43% |

| Arvind | Jul -21 | 569 | 263% |

| Note: As of May 31, 2024. For returns, the purchase has been assumed to be on the last day of the month when the stock first appeared in the portfolio. | |||

Also read: Quant has a problem