AI-generated image

AI-generated image

If you think that debt mutual funds and FDs (fixed deposits) are the only short-term investment options, think again. There's another option that you might not be aware of - NPS Tier II.

NPS (National Pension Scheme) Tier II allows you to allocate 100 per cent of your money to debt securities (if you choose the 'Active' choice). What's more, they don't have a lock-in period. This means that you, the investor, can withdraw your funds at any time.

So, should you pick NPS Tier II over shorter-duration debt funds, which is what we usually recommend over FDs for short-term investing? Let's find out which one reigns supreme.

#1 Ease of investment

It's pretty easy to invest in a debt fund. You can invest directly through the fund house's website or various intermediaries (mutual fund distributors or brokerage platforms). All you have to do is provide the necessary documents and pick the suitable fund(s).

On the other hand, you need to be an NPS Tier I subscriber to invest in its Tier II option.

#2 Flexibility of withdrawal

In terms of liquidity, both debt funds and NPS Tier II are on equal footing, as neither has a lock-in period.

Further, their turnaround time is also quite similar. It takes 2-3 working days for the NPS Tier II money to be credited to your bank account; with debt funds, it takes two days.

#3 Taxation

Here, too, debt funds and NPS Tier II are at par with each other. During withdrawals, both are subject to the usual tax implications based on your income tax slab.

#4 Returns

A quick glance would hand the crown to NPS Tier II. However, there's a but.

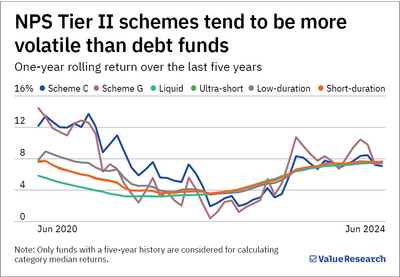

If you look at the graph, the returns of NPS Tier II's Scheme C (invests in corporate bonds) and Scheme G (invests in government bonds) appear to ebb and flow dramatically. This is because they invest in bonds with higher maturities, leading to increased interest rate risk and, consequently, more volatile returns in the short term.

Meanwhile, shorter-duration debt funds appear far more stable. Since these funds invest in bonds that mature sooner, they are not as prone to short-term volatility as NPS Tier II, which is why they are more suitable for short-term investments.

Moreover, the returns for both options have been neck and neck in the past 12 months.

Which is the better option?

When it comes to short-term investing, shorter-duration debt funds remain the numero uno option. Although they don't enjoy a significant advantage over NPS Tier II, they are far less volatile in the short term, which is what an investor seeks in such situations.

Which debt fund to invest in?

We recommend liquid, ultra-short and short-duration debt funds. These debt funds offer the stability you need without the added short-term volatility. So, until we find a better alternative, keep your short-term investments secure in these funds.

Also read: NPS vs PPF vs EPF: The best retirement investment option