AI-generated image

AI-generated image

HDFC AMC launched its latest passive fund offering, the HDFC Nifty 100 Low Volatility 30 Index Fund. This fund will invest in large-cap stocks with the lowest price fluctuations over the last year. It opened for subscription on June 21, 2024, and will remain available until July 5, 2024.

Below are the key details of the NFO (new fund offer).

NFO at a glance

| Fund name | HDFC Nifty 100 Low Volatility 30 Index Fund |

| SEBI category | Index fund |

| Scheme type | Open-ended |

| NFO period | June 21-July 5, 2024 |

| Benchmark | Nifty 100 Low Volatility 30 Total Returns Index (TRI) |

| Fund manager(s) | Nirman S Morakhia and Arun Agarwal |

| Exit load | Nil |

| Taxation |

If the units are sold after a year, a 10 per cent tax will be applicable on gains exceeding Rs 1 lakh. If the units are sold within a year of purchase, a 15 per cent tax will be levied. |

About the fund

The HDFC Nifty 100 Low Volatility 30 Index Fund is a passive, open-ended fund that aims to generate returns by replicating the performance of the Nifty 100 Low Volatility 30 TRI.

Four other AMCs have launched such funds previously, all of which have given double-digit returns since inception.

Funds replicating the Nifty 100 Low Volatility 30 TRI

All of them have delivered impressively since launch

| Fund name | Launch date | Returns since inception (%) |

|---|---|---|

| ICICI Prudential Nifty 100 Low volatility 30 ETF | July 03,2017 | 15.74 |

| Kotak Nifty 100 Low volatility 30 ETF | March 23,2022 | 21.09 |

| Bandhan Nifty 100 Low Volatility 30 Index Fund | October 06,2022 | 24.60 |

| Mirae Nifty 100 Low volatility 30 ETF | March 24,2023 | 36.81 |

| Note: Returns are as of June 25, 2024 | ||

About the index

Since HDFC AMC's latest fund will track the Nifty 100 Low Volatility 30 TRI to generate returns, let's understand how the latter works.

The Nifty 100 Low Volatility 30 TRI chooses 30 stocks from the Nifty 100 that experienced the least price fluctuation in the last 12 months. The stock with the lowest volatility in the index is assigned the highest weight. The index will be rebalanced quarterly.

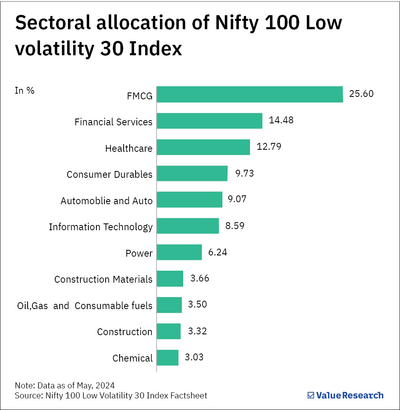

Sectoral weightage

From the graph, we can see that the top three sectors (FMCG, Financial Services and Healthcare) have a total weightage of around 52.9 per cent, while the top five sectors (FMCG, Financial Services, Healthcare, Consumer Durables and Automobile and Auto) have a collective weightage of roughly 71.7 per cent. This shows that the underlying stocks of the Nifty 100 Low Volatility 30 TRI are highly concentrated among a handful of industries.

Top 5 stocks of Nifty 100 Low Volatility 30 TRI

The lower the 12-month price volatility, the higher the weight of the company

| Company name | Weight (%) |

|---|---|

| Hindustan Unilever | 4.45 |

| ICICI Bank Ltd | 4.34 |

| Britannia Industries | 4.14 |

| Asian Paints | 3.99 |

| ITC | 3.81 |

| Note: Data as of May 2024 Source: Nifty 100 Low Volatility 30 Index Factsheet | |

Comparison with Nifty 100

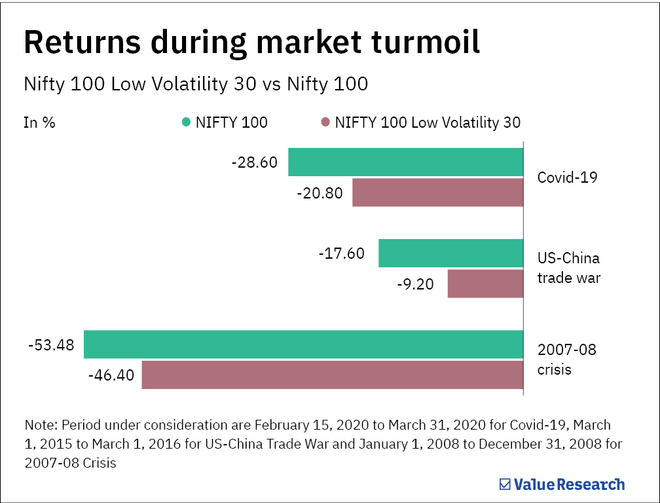

A quick comparison with the Nifty 100 shows that the Nifty 100 Low Volatility 30 TRI has a lower downside.

As indicated in the graph below, while both indices delivered negative returns during periods of economic instability, the Nifty 100 Low Volatility 30 TRI fell less than its parent index, the Nifty 100.

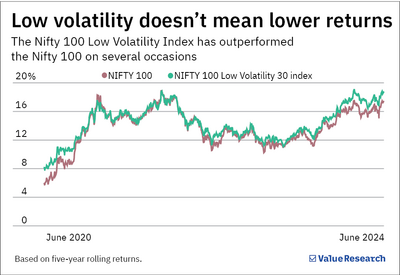

Yet, the lower volatility of the Nifty 100 Low Volatility 30 TRI doesn't imply lower returns. Between June 2020 and April 2024, the index's returns were on par with those of the Nifty 100, even briefly outperforming it last year.

About the fund managers

Nirman S Morakhia and Arun Agarwal will jointly manage the fund.

Morakhia has been with HDFC AMC since 2018. He has over 14 years of experience in equities. Presently, he manages 14 passive schemes (excluding fund of funds) at the fund house.

Agarwal has over 23 years of experience across equity, debt and derivative dealing, fund management, internal audit and treasury operations. Some of the funds he currently manages include the HDFC Nifty Realty Index Fund , HDFC Nifty PSU Bank ETF and the HDFC BSE 500 Index Fund.

Our take

At Value Research, we have long believed that diversified equity funds like flexi-cap funds are better suited for investors as they invest across sectors. Further, these funds are more suited for long-term wealth creation.

However, if you are keen on investing in such factor-based funds, we suggest allocating only 5-10 per cent of your portfolio to them.

Also read: Ask these three questions before investing in an NFO