AI-generated image

AI-generated image

Investing in the stock market is akin to riding a roller coaster. It has its all-time highs and its stomach-churning lows. That's volatility for you, dear investor.

Take Bajaj Finance and Trent , for instance. Their shareholders have faced drawdowns of at least 20 per cent seven and six times, respectively, in the last 10 years. In fact, Bajaj Finance plunged nearly 60 per cent from its 2019 peak in the Covid-19 aftermath. Would you still have had the nerves to hold on to it, then?

A rocky ride

Bajaj Finance and Trent's significant drawdowns over the years

| Year | Bajaj Finance | Trent |

|---|---|---|

| 2015 | -3.7 | -31.3 |

| 2016 | -11.5 | -23.8 |

| 2017 | -28.5 | -24.1 |

| 2018 | -23.9 | -19.7 |

| 2019 | -21.2 | -18.3 |

| 2020 | -58.3 | -35.2 |

| 2021 | -18.8 | -27.3 |

| 2022 | -34.7 | -18.6 |

| 2023 | -31.8 | -26.5 |

| 2024 | -24.4 | -3.9 |

| Data as of June 21, 2024. | ||

If you are a Nervous Nellie, the odds are stacked against you. This is because despite the steep decline that the two companies witnessed, they have been two of the biggest wealth creators in the last 10 years. Bajaj Finance and Trent have multiplied their shareholders' wealth by 36 and 42 times, respectively. In fact, if investors had invested more in these companies after each major fall, their returns would have been even higher.

However, demonstrating such conviction in the face of fear is easier said than done. Given that the stock market is a confluence of the emotions and opinions of everyone participating in it, volatility cannot be eliminated. It is par for the course. So, how do you deal with it?

1. Think long term

You should not equate the daily ups and downs of the stock market with changes in the true value of a business. In the short term, the stock market is influenced by a plethora of factors, from economic indicators to quarterly earnings surprises. However, over the longer term, the market reflects the factors that count—business fundamentals.

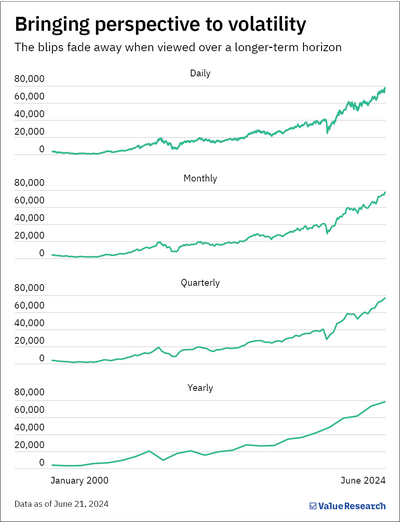

Look at the graph 'Bringing perspective to volatility.' You will notice that as the horizon shifts from daily to yearly, many bumps on the road get smoothened! This is why you should look beyond the market's short-term mood swings and focus on creating long-term value.

2. Don't time the market

Timing the market is attempting to predict its future movements-buying when an upward trend is anticipated and selling when there is an expectation of a downturn. This approach is outright speculative and it is impossible to predict and profit from the market's short-term movements consistently.

Let us explain. We did some number-crunching and backtested BSE Sensex data for the past 10 years.

Had you invested Rs 1 lakh in Sensex on the first trading day of each year, you would have comfortably generated an annualised return of 13.4 per cent. On the other hand, had you invested Rs 1 lakh each year at the lowest value of Sensex, you would have generated an annualised return of 15.7 per cent in the last decade.

Although the second scenario looks ideal, it cannot be achieved simply because predicting market dips beforehand is impossible. Thus, a near-certain 13.4 per cent annual return (first scenario) would still be better than an imaginary and unguaranteed 15.7 per cent annual return.

Instead of timing the market, investors should try pricing the market (or stock). That is, purchasing stocks when they are below their fair value and selling them when they rise above it. This will ensure you don't overpay at the time of purchase. Click here to learn if a stock is expensive.

Your takeaway

Volatility is part and parcel of the stock market and cannot be escaped. However, it can be navigated swiftly by developing a long-term perspective and avoiding falling prey to short-term movements. Do not let fear overtake you and stay put in companies whose fundamentals you trust.

Also read: Buffett's billion-dollar read