AI-generated image

AI-generated image

Amazon, Netflix, Google-these are a few names that not only form part of our daily lives, but also the portfolios of many Indians. As a result, it becomes crucial to properly disclose any income from foreign stocks in your income tax return (ITR) to avoid any nasty tax surprises later.

With July 31 marking the last date for filing ITR for salaried individuals, we thought it would be the perfect time to guide you on disclosing income from foreign stocks, particularly US stocks, in your ITR. We offer you a DIY (do it yourself) guide.

Types of income from US stocks and their taxation

Before we begin, it is important to understand how one can earn income from US stocks. There are primarily two ways:

1. Dividends: Dividends on your US stock holdings are taxed at a flat rate of 25 per cent in the US. The dividend income is also subject to tax in India. The amount you receive as dividends is added to your total income and taxed according to your income tax slab.

However, to avoid being taxed twice on the same income, India and the US have a Double Taxation Avoidance Agreement (DTAA). Under this agreement, you can reduce the amount of tax you owe in India by the amount of tax you've already paid in the US.

2. Capital gains: The US does not tax capital gains you earn from selling US stocks if you are a non-resident of the US. However, you will need to pay taxes on these gains in India. The tax treatment depends on how long you held the investments before selling them:

- Short-term capital gain tax (STCG): If you held the stocks for less than 24 months, the gains will be added to your taxable income and taxed according to the income-tax slab applicable to you.

- Long-term capital gain tax (LTCG): If you held the stocks for more than 24 months, you will be liable to pay a capital gains tax of 20 per cent with indexation benefit.

Steps to disclose US stock investments

First up, gather the necessary documents related to your US stock investments from your broker. These are:

- Capital gain summary statement

- Schedule TR (Tax relief)

- Foreign asset schedule

- Form 1042-S

You may refer to our article, 'How to file your ITR' to follow the basic steps of filing your ITR. To disclose foreign income from stocks in your ITR, you'll need to select the following additional schedules:

In the Income tab:

- Schedule Foreign Source Income

- Schedule Tax Relief under Section 90, 90A or 91

- Schedule Capital Gains

- Schedule Other Sources

In the Others tab:

- Schedule Foreign Assets

- Schedule Assets and Liabilities (if your total income exceeds Rs 50 lakh)

After selecting these schedules, click on 'Continue', and you will land on a page with a list of all the schedules that you selected. You will need to fill these schedules one by one. Let's talk about the most complicated ones.

Schedule Capital Gains

From the given options, select 'From sale of assets other than all the above listed items' and click on 'Continue'. You will land on a page where you have to disclose details of capital assets sold.

Click on 'From sale of assets other than all above listed items' and click on 'Add details'. You will need the capital gain summary statement to fill this segment.

If you sold an investment in less than 24 months, select 'Short-term capital gain'. If you sold after 24 months, select 'Long-term capital gain.' Then click on the 'Add' option.

Put the total amount of investments you have sold during a year in 'a(ii)'. Ensure that this amount is in INR, not dollars. Also, don't forget to net off your losses, if any, from these gains.

Next, scroll below to 'b(i)' and mention your cost of purchase of investments. Your total gain will be reflected in 'c [Balance]'. Click on 'Confirm' to submit Schedule Capital Gains. You will then land on the schedule summary page.

Income from other sources

In this, you will disclose dividend and interest income from investments in the US.

Click on the 'Add Another' button. You will see a drop-down list with the head 'Nature of income'. Select 'Dividends' from that list.

Put the dividend amount you received during the year in INR in 'i. Dividend income [other than (ii)],' and click on 'Confirm.'

You will again land on 'Schedule other sources.' On this page, select option 'Information about accrual/receipt of income from other sources.'

Here, you must disclose the dividend you received every quarter. Enter the amount in the second row.

Scroll down, click 'Confirm', and you will land on the schedule summary page.

Schedule FSI (foreign source income)

To fill this schedule, you will need the Schedule TR (Tax Relief) document.

Click on 'Add Details'. Select United States from the dropdown. Next, select the Head of income as 'Capital gains'.

Below that, fill your capital gains from selling investments during the year in 'Income from outside India offered for tax in India.' (Don't add income from dividends or interest in this).

Next, calculate tax as per your tax slab on capital gain entered above and fill it in 'Tax paid outside India.'

After this, tap 'Other sources' under Head of income to disclose interest and dividends received during the year.

Add dividend and interest and put it in 'Income from outside India offered for tax in India.'

In 'Tax paid outside India', fill in the tax amount from the Schedule TR document.

Next, you will have to calculate tax as per your income tax slab since dividends and interest earned from US investments are considered other income and added to the main income. So, if you fall under the 30 per cent tax slab, calculate accordingly and fill it in 'Tax payable on such income under normal provisions in India.'

Write '90' in 'Relevant article of DTAA if relief claimed u/s 90 or 90A' and click on 'Confirm'. You will land on the schedule summary page.

Schedule Tax Relief under Section 90, 90A or 91

This section will be automatically filled out as per the schedule filled out before this.

Simply answer 'No' to the question that follows and click on 'Confirm' to submit the schedule. You will then land on the schedule summary page.

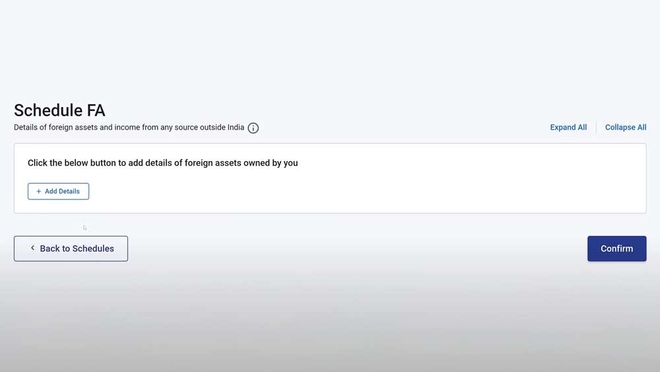

Schedule FA

Select it from the schedule summary. For this, you will need foreign asset schedule document received from the broker.

Click on Add details and select 'A3. Details of foreign equity and debt interest.' Below that, select the country name as United States.

Next, provide details of every stock held by you one by one from Schedule FA. If you hold too many stocks, you can opt for another option. Click on 'Downloads' on the homepage of the website, select 'Income tax returns', select assessment year, and click ITR 2. Here you will see 'Utility Excel Based.' Download it and fill it out accordingly.

Form 67

Go to the 'e-File' section at the top of the portal. Select 'Income tax forms' and find Form 67. This is to be filled out to claim a tax credit on dividends and interest paid in the US. You don't have to consider capital gains while filling out this form.

Click on 'File now'. Select the assessment year and click on 'Continue'.

There are four parts to this form that you have to fill out.

- Select 'Part-A' and fill in the details of your dividend and interest.

Next, fill in article numbers of DTAA and tax rate as per DTAA as below. - In 'Part B', choose the answers to questions as 'No'.

- Next, fill in your basic details in the 'Verification' tab.

- Attach 1042-S form provided by the broker in the 'Attachments' tab.

Click on Save and you are done!

These were the steps to disclose income from US stocks in your ITR. You may proceed to file the remaining ITR by following the steps here.

Also read: You can still buy ETFs to invest overseas. But here's what you must consider