HDFC Nifty500 Multicap 50:25:25 Index Fund NFO opened for subscription on August 6, 2024, and will be available for investors to subscribe until August 20, 2024.

This index fund will be the second fund to track the Nifty500 Multicap 50:25:25 Index. The first was the Navi Nifty 500 Multicap 50:25:25 Index Fund, which launched on August 1, 2024.

HDFC Nifty500 Multicap 50:25:25 Index Fund NFO at a glance

| NFO period | August 6-20, 2024 |

| Benchmark | Nifty500 Multicap 50:25:25 |

| Fund managers | Nirman Morakhia and Arun Agarwal |

| Exit load | Nil |

| Tax treatment | If units are sold within a year: 20 per cent capital gains tax. If units are sold after one year: 12.5 per cent capital gains tax. (Gains up to Rs 1.25 lakh are tax-exempt) |

About HDFC Nifty500 Multicap 50:25:25 Index Fund's benchmark

Since HDFC Nifty500 Multicap 50:25:25 aims to replicate the Nifty500 Multicap 50:25:25 Index, let's delve into the details of the latter.

The Nifty500 Multicap 50:25:25 Index includes all the companies that are part of the Nifty 500 Index. But there's a key difference between the two indexes. In the Nifty 500, large-, mid-, and small-cap weights are based on total free-float market capitalisation, resulting in approximate weights of 72 per cent for large cap, 18 per cent for mid cap, and 10 per cent for small cap. However, the Nifty500 Multicap 50:25:25 Index is slightly overweight on mid and small caps, with weights fixed at 50 per cent for large cap, 25 per cent for mid cap and 25 per cent for small cap.

Performance of the Nifty500 Multicap 50:25:25 Index

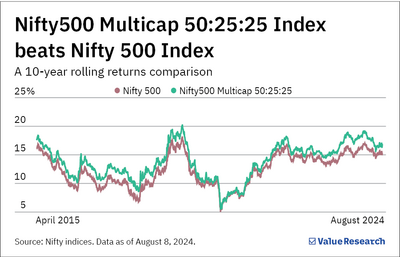

Since the Nifty500 Multicap 50:25:25 Index includes all the companies from the Nifty 500, it makes sense to compare their performance.

A 10-year rolling return analysis shows that the Nifty500 Multicap 50:25:25 often outperforms the Nifty 500, as can be seen in the graph.

To put it in numbers, the Nifty500 Multicap 50:25:25 has delivered an average 10-year return of around 13.9 per cent, compared to the Nifty 500's 12.4 per cent over the same period.

We also compared the performance of the Nifty500 Multicap 50:25:25 Index with that of multi-cap funds, as they have slightly similar investing strategies. For the uninitiated, multi-cap funds are mandated to invest at least 25 per cent each in large, mid and small caps. The remaining 25 per cent can be invested anywhere as per the discretion of the fund manager.

Although multi-cap funds have a limited history, they started enjoying significant growth only since 2021. We noted that they have beaten the Nifty500 Multicap 50:25:25 Index in 29 out of 43 months on monthly category average returns since January 2021. That's roughly 67 per cent of the time.

Fund managers of HDFC Nifty500 Multicap 50:25:25 Index Fund

Nirman Morakhia and Arun Agarwal will jointly manage this fund.

Morakhia has over 14 years of experience in equities. He has been with HDFC AMC since 2018. Presently, he manages 20 schemes (excluding fund of funds) at the fund house.

Agarwal brings over 23 years of experience in equity, debt, and derivatives dealing, as well as fund management, internal audit, and treasury operations. He currently manages several funds, including the HDFC Nifty Realty Index Fund, HDFC Nifty PSU Bank ETF and HDFC BSE 500 Index Fund.

Should you invest in HDFC Nifty500 Multicap 50:25:25 Index Fund?

The HDFC Nifty500 Multicap 50:25:25 Index Fund is a passive fund. The fund manager does not have the flexibility here to choose stocks. While it can be cost-effective compared to an actively managed fund, it is more rigid in investing. The fund is obligated to invest in all the stocks of the Nifty 500 regardless of their investment merit.

On the performance front, while the Nifty500 Multicap 50:25:25 Index has outperformed the Nifty 500 over a 10-year period, it is not so impressive when compared to actively managed multi-cap funds. Additionally, do note that actively managed funds have also shown the potential for higher long-term returns in the mid- and small-cap segments.

Therefore, we recommend considering actively managed diversified equity funds like multi-cap and flexi-cap funds. These funds give managers the freedom to invest selectively.

That said, if you are keen on investing in this index fund, you can consider allocating a small portion of your portfolio.

Also read: Ask these three questions before investing in an NFO