Aditya Birla Sun Life Nifty India Defence Index Fund NFO opened for subscription on August 9 and will remain open until August 23, 2024.

The new fund will be passively managed, meaning it will replicate the Nifty India Defence Total Return Index (TRI). For instance, if company A has a 5 per cent weight in the index, the Aditya Birla Sun Life Nifty India Defence Index Fund will also invest 5 per cent of its money in that company.

Aditya Birla Sun Life Nifty India Defence Index NFO at a glance

| NFO Period | August 9 to August 23, 2024. |

| Benchmark | Nifty India Defence TRI |

| Fund Manager(s) | Haresh Mehta and Pranav Gupta |

| Exit Load | 0.05 per cent of the applicable NAV if redeemed before 30 days. No exit load after that. |

| Tax treatment |

If units are sold within a year, capital gains will be taxed at 20 per cent. If units are sold after a year, capital gains will be taxed at 12.5 per cent. However, gains of up to Rs 1.25 lakh are tax-exempt. |

About Nifty India Defence Total Return Index (TRI)

Since the new defence fund will try to copy the Nifty India Defence Total Return Index (TRI), let's get to know it better.

-

This index, established on April 2, 2018, considers companies that derive at least 10 per cent of their revenue from the defence segment.

-

The weight of each company is determined by its market value.That said, no company can have more than 20 per cent weight in the stock.

- This index is reconstituted twice a year. Reconstitution is a process of reviewing and making changes to the index. This can include adding or removing companies and adjusting the weightings of each stock.

Currently, Bharat Electronics Limited (BHEL) has the largest presence in the index, with a weight of 19.38 per cent. Hindustan Aeronautics Limited (HAL), at 17.40 per cent, and Solar Industries, 14.41 per cent, occupy the second and third slots.

Together, these three companies account for 51.19 per cent of the index, while the top five stocks make up around 70 per cent.

Nifty India Defence Total Return Index (TRI) performance

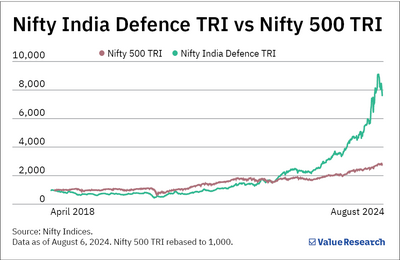

The defence index has been on a tear in recent years. Since its inception (April 2, 2018), the Nifty India Defence Index has delivered an annualised return of 37 per cent, more than double than the broader market's Nifty 500's 16.5 per cent in the same period.

Simply put, if you had invested Rs 10,000 each in the Nifty Defence Index and the Nifty 500 on April 2, 2018, your investments would now be worth approximately Rs 76,027 and Rs 26,680, respectively. This can also be seen in the graph.

However, if you scratch the surface, the defence index hasn't been all sugar and spice. In fact, it underperformed the Nifty 500 for more than four years, between April 2018 and June 2022. The index came to its own only after that, thanks to the government's indigenisation push and higher defence exports. In the previous financial year 2023-24 alone, India's defence exports surged by 32.5 per cent than a year ago.

Aditya Birla Sun Life Nifty India Defence Index fund managers

Back to the fund, Haresh Mehta and Pranav Gupta will oversee it.

Mehta has 17 years of work experience in dealing-related activities and currently manages 16 funds for ABSL AMC (short for Aditya Birla Sun Life), which is the sixth-largest fund house in the country. Gupta, meanwhile, has over six years of experience in the capital markets and presides over 17 funds for the company.

Aditya Birla Sun Life Nifty India Defence Index: Should you invest?

Given the recent strong performance of the Nifty India Defence Index, investing in this NFO might seem appealing. However, consider the following factors before proceeding

-

High concentration risk:

As mentioned earlier, the top three stocks make up about 51 per cent of the index's weight. This means that a little more than half of your portfolio's performance will rely on the performance of just three stocks. That can get tricky, especially for risk-off investors.

-

Higher valuation:

India's defence sector may be poised for growth going forward, but the valuation of these companies is sky-high. In other words, you'd be investing in these companies at a high premium, thereby shrinking your future gains.

- No sector or theme is evergreen: Periods of outperformance by a sector are usually followed by poor performance. For example, the defence sector underperformed for over four years before rebounding in the last couple of years. Therefore, high reliance on one specific sector can be risky.

Instead, investing in diversified funds like flexi-cap or multi-cap funds is advisable. Such funds spread their money across sectors, including defence, to reduce risk.

Also read: Three questions to ask before investing in an NFO