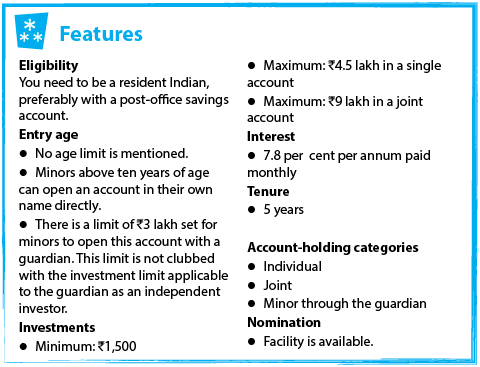

The Post Office Monthly Income Scheme (POMIS) is a guaranteed-return investment available at the post office. On the deposit that you make with the post office, you get an assured monthly income. Currently, one earns a 7.8 per cent interest per year on the deposit, which is paid every month and hence the name ‘monthly income scheme’. Once you make the deposit you get the interest payout each month from the date of making the investment, not from the start of the month.

Investment objective

The main objective of the POMIS is to provide an assured monthly return to account holders and help them create a guaranteed regular income. Though it offers no tax incentives, it is a preferred instrument amongst small savers for the government backing that this product offers.

Capital protection

The capital in the POMIS is completely protected as the Scheme is backed by the Government of India, making it totally risk-free with guaranteed returns.

Inflation protection

The POMIS is not inflation protected, which means whenever inflation is above the current guaranteed interest rate, the return from the Scheme earns no real returns. However, when the inflation rate is below what it offers, it does manage a positive real rate of return.

Guarantees

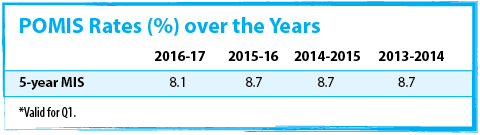

The interest rate for the POMIS is guaranteed and is currently 7.80 per cent per annum for the first quarter of 2016–17. The interest is paid out monthly. The interest rates will be notified every quarter in line with G-sec rates of similar maturity, with a spread of 0.25 per cent. The interest applicable to you for the duration of the deposit will be the rate at which you make the deposit.

Liquidity

The POMIS is liquid despite the five-year stipulated lock-in. Liquidity is offered in the form of withdrawals.

Credit rating

As the POMIS is backed by the Government of India, it does not require any commercial rating.

Exit option

Premature closing of the account is permitted with penalty.

Other risks

There are no risks associated with this investment.

Tax implications

There is no tax benefit on the investment or the income earned from this scheme.

Where to open an account

You can open the account at any head or general post office.

How to open an account

You will first need to open a post-office savings account to link the monthly payout from your MIS account and you will need the following documents:

- An account-opening form, which the post office will provide

- Two passport-size photographs

- Address and identity proof such as the Aadhaar card; passport; PAN (permanent account number) card or declaration in the Form 60 or 61 as per the Income Tax Act, 1961; driving licence; voter’s identity card; or ration card.

- Carry original identity proof for verification at the time of account opening.

- Choose a nominee and get a witness signature to complete the formalities to get started.

How to operate the account

You need a pay-in slip with the initial account-opening sum to be credited into your account.

Points to Remember

- Portability of the account between post offices is possible.

- Reinvestment on the maturity of the account is possible.

- Maturity proceeds not drawn are eligible to savings-account interest rate for a maximum period of two years.

- Interest income is taxable but there is no tax-deducted-at-source (TDS) certificate issued.