The Kisan Vikas Patra (KVP) is a popular and safe small-savings instrument that doubles the invested money in 9 years and 3 months. This scheme is backed by the government. After withdrawing it, the government relaunched it on November 18, 2014. The money raised through the KVP is used in the welfare schemes for farmers.

Capital Protection

The capital in the KVP is completely protected as the scheme is backed by the Government of India.

Inflation Protection

The KVP is not inflation protected. This means that whenever inflation is above the current guaranteed interest rate, the deposit earns no real returns. However, when the inflation rate is under 8.7 per cent, the KVP can manage to give a positive real rate of return.

Guarantees

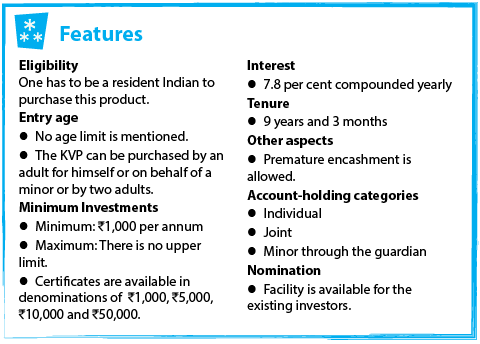

The interest rate in the KVP is guaranteed. Currently, it is 7.8 per cent compounded yearly. The KVP rates will now be notified every quarter as per the prevailing government-bond rates. However, once you have made an investment, the rate will remain unchanged for you throughout the tenure.

Liquidity

The KVP is liquid. Liquidity is offered in the form of loans and withdrawals subject to conditions. The minimum lock-in period is 30 months, after which one can encash it. Also, it can be transferred from one person to another any number of times.

- The facility of pledging the KVP to borrow is allowed and one can take loans against the KVP from banks and financial institutions.

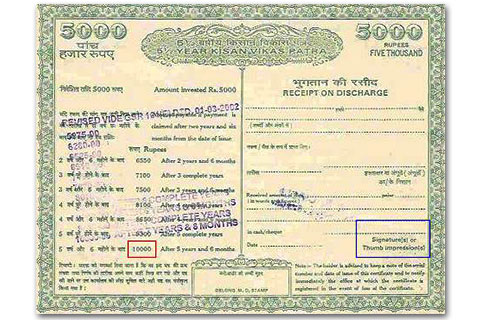

- Premature closure of the KVP is permitted wherein a pre-fixed value of the KVP is paid as indicated in the table.

Credit Rating

As the KVP is backed by the Government of India, it does not require any commercial rating.

Exit Option

Premature withdrawal is permitted at a cost for investors.

Tax Implications

For the existing investors, there is no tax benefit on the deposit or the interest that the KVP earns. There is no tax deducted at source.

Where to Buy

One can buy the KVP at any head post office, general post office, any designated nationalised bank or State Bank of India and its associate banks.

How to Buy

- You have to fill the KVP application form available at the post office or the designated banks.

- Original identity proof for verification at the time of buying is required.

- You can buy the certificate with cash, cheque or demand draft drawn in favour of the postmaster of the post office from where the KVP is being bought.

- You have to choose a nominee and get a witness signature to complete the formalities.

Points to Remember

- The KVP can be encashed at any post office or nationalised bank in India, provided one has obtained transfer certificate to the desired post office or bank.

- The KVP are transferable across post offices and designated banks for the existing investors.

- Interest income is taxable but no tax is deducted at the source.