Sundaram AMC is unique. It is one of the few fund houses that is now headed by the owner. It was launched in 1997 as a joint venture between Sundaram Finance and Stewart Newton Holdings (Mauritius), a subsidiary of the UK-based Newton Investment Management. In 2001, the fund house underwent a change in partnership with Newton's exit because of global re-alignment when Newton was bought by US-based Mellon Financial Corporation. Sundaram bought Newton's stake in 2003. In 2005, the AMC went in for a new partnership with BNP Paribas Asset Management which picked up 49.90 per cent stake, when the AMC was renamed Sundaram BNP Paribas AMC. Global re-alignment in 2010 resulted in BNP Paribas exiting the venture, leaving Sundaram on its own.

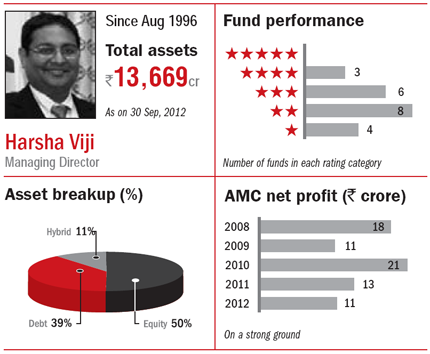

The fund house has offerings across both equity and debt, with several niche fund schemes such as its select focus and select mid-cap fund, which is in stark contrast to the conservative image Sundaram group has carved out for itself over the years. The fund house has built up its offerings with several capital protection-oriented funds. But all these niche innovations by the AMC make it vulnerable to market cyclicality though. Also, the inability to sustain reasonable performance of its leading equity funds has disappointed investors.