I have been reading your magazine for the past few months and closely follow the recommendations that you make. I have noticed that you have been recommending both NMDC and GMDC as good long-term investment bets. If I were to choose one of these two stocks for a fairly long-term investment (more than 5 years or even longer) with the goal of 10x kind of returns, which one would you recommend?

– Kamlesh Mutha

NMDC and GMDC (Gujarat Mineral Development Corp) are part of the mining sector but differ in their mining products. NMDC is into the mining of all kinds of iron ore whereas GMDC mines minerals such as lignite, bauxite and manganese. Moreover, GMDC is also into power generation while NMDC has a diamond mine in Panna.

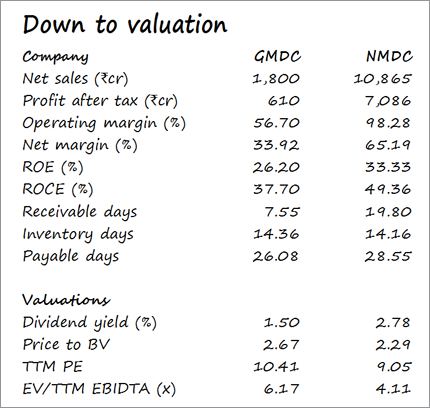

Financially and valuation-wise too there are some similarities. NMDC's revenues have grown at 22 per cent per annum in the last 5 years which is in line with GMDC's revenue that grew 23 per cent over the same period. NMDC has more financial efficiency over GMDC in terms of margins and profitability but GMDC has better operational efficiency, as evident from its balance sheet.

With infrastructure still a priority in India, both the companies have good long-term prospects: While NMDC enjoys economies of scale, GMDC can leverage upon growing its scale. Both the companies are currently undervalued due to the fact both are government-owned. You should base your investment decision on the basis of valuation, as in, which one is more undervalued as of now. Currently, NMDC is relatively more undervalued partly because of the recent dilution by government at discounted prices. NMDC is trading at price to earnings of 8.9 which is 54 per cent discount to its 5-year median of 19.5 whereas GMDC is trading at 10.4 which is 16.6 per cent discount to its 5-year median of 12.5.