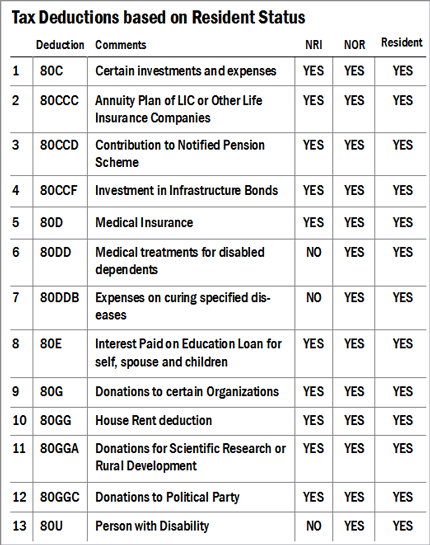

A tax deduction is the reduction you can claim under different heads to cut your tax liability, thereby reducing your income tax. The income tax act in India has made allowances for deductions in various sections, and these are listed below.

Section 80C

Section 80C offers a window of investment opportunities of up to Rs 1.5 lakh in each financial year. This benefit is available to everyone, irrespective of their income levels. For instance, if you are in the highest tax bracket of 30 per cent, the investment of Rs 1.5 lakh under this section will save you Rs 46,800 (including education and Secondary and Higher Education cess) each year. The various financial products that qualify for Section 80C benefits are as follows:

- Life Insurance premium payment

- Home loan principal repaid, wherein the principal portion of the home loan EMI qualifies for deduction under Section 80C

- Employees Provident Fund (EPF) where 12 per cent of your salary is deducted every month, and an equal amount is contributed by your employer and put into a fund maintained by the government or your company's provident fund trust. Only your contribution towards the fund is eligible for deduction from taxable income of the basic salary.

- Tuition fees for up to two children can be claimed. However, any payment towards any development fees or donation to institutions is excluded

- Contributions to the public provident fund

- Investments in the senior citizens' savings scheme

- Savings in notified term deposits in scheduled banks with a minimum period of five years under the bank term deposit scheme, 2006.

- Savings in post office time deposits with a 5-year lock-in

- National Savings Certificate, five-year government-backed security available at post offices

- Investments in tax planning mutual funds, popularly known as Equity-Linked Savings Scheme (ELSS)

- Investments in pension plans

- Investment in Sukanya Samriddhi Yojana

- Apart from the Rs 1.5 lakh deduction allowed under Section 80C, an additional Rs 50,000 deduction is available on investment in National Pension System (NPS)

Other Deductions

Section 80D: Premium payments towards medical insurance for self, spouse, children and parents qualify for a deduction. You can claim up to Rs 25,000 or Rs 50,000 (if you or your spouse is a senior citizen) for self, spouse and dependent children. Additional deduction of up to Rs 25,000 or Rs 50,000 is available for premium paid parents' policy. Preventive health check-ups up to Rs 5,000 within limits also qualify for tax deductions under section 80D.

Section 24: Interest on a home loan with a maximum deduction of Rs 2 lakh as interest payment on the home loan.

Section 80E: Interest on an educational loan qualifies for a deduction on full-time studies for any graduate or postgraduate course. However, there is no benefit on principal repayments.

Section 80G: Donations to funds and charities - 50 or 100 per cent of the donated amount, depending on the charity - is deductible from income. But this shouldn't exceed 10 per cent of your total gross income.

Section 80DD: Deduction of up to Rs 75,000 or Rs 1.25 lakh (in case of severe disability) on the medical treatment of a dependent with a disability, certified by a medical authority.

Section 80DDB: Deduction of up to Rs 40,000 for an individual under 60 years of age and Rs 100,000 for senior citizens on costs incurred for treatment of specified illnesses such as cancer, chronic renal failure, Parkinson's disease and other listed diseases.