There are two kinds of investors in this world, those who understand compounding and those who don't. Almost everyone who invests claims to understand compounding, but very few grasp its potential to grow their money in a big way.

This is because compounding produces such unintuitive results that perhaps only a few mathematically-inclined individuals can be expected to have a real feel for it. The rest of us must rely on calculations because instinctively, the human mind seems capable only of arithmetic (simple) growth and not geometric (compounded) growth. The fact that investment growing at 10 per cent a year would become more than double in the first 10 years, about six times in another 10 years and nearly 16 times in further 10 years, isn't obvious to most people.

But first, let's define what compounding is exactly. Compound interest arises when interest is added to the principal, so that from that moment on, the interest that has been added also earns interest. This addition of interest to the principal is called compounding. For instance, suppose you put Rs 100 in the bank at a 10% interest rate compounded annually, at the end of the first year, the interest will be Rs 10. Now, in the second year, the 10% interest applies to both your initial amount and the interest earned the previous year, that is to the total amount of Rs 110. The next year, the second year's interest gets added, and so on and so on. Although we use the word 'interest', the idea of compounding applies equally to all forms of returns, not just those that are called interest.

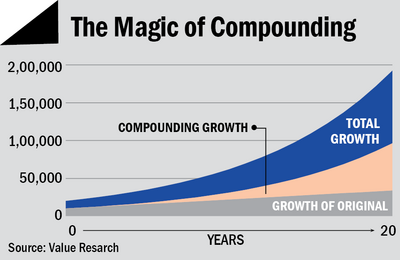

The biggest thing to appreciate about compounding is the value of time. As your returns start earning, and then the returns on those returns start earning, the profits start piling up.

The graph given here shows this clearly. The blue line starts rising slowly, but as compounding takes over, the extra time means a lot more income. Translated into a human lifetime, it means that starting to save at the age of 30 instead of 50 can mean retiring with four times the wealth. The graph shows this clearly. Thus the best way to take advantage of compounding is to start saving and investing wisely as early as possible. The earlier you start investing, the greater will be the power of compounding. If one has time to learn just one thing about investing, then this should be it.