There are certain inherent advantages that holding companies have. Typically these companies own assets and rarely have active business operations. When analysing holdings of listed companies, we came across two interesting stock ideas, which if used well could become good alternate investments. Both Maharashtra Scooters and Tata Investment Corporation (TIC) hold investments in several Bajaj group and Tata group companies. TIC also has investments in several non Tata group companies.

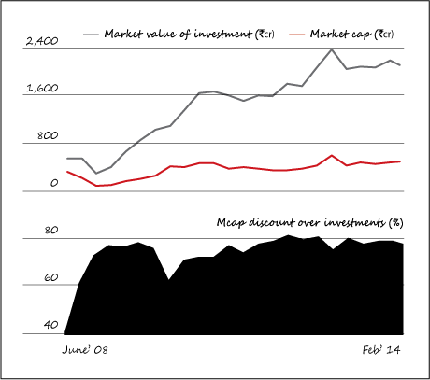

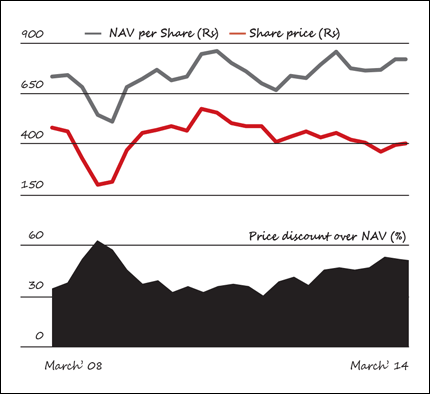

Both these companies are trading at huge discount to their investment value which is up to 50 per cent. The huge discount coupled with high dividend yield serve as investment opportunity to indirectly invest in the Bajaj or Tata group companies. However, all good things come with a caveat; you need a lot patience to invest in holding companies to realise value.

Tata Investments

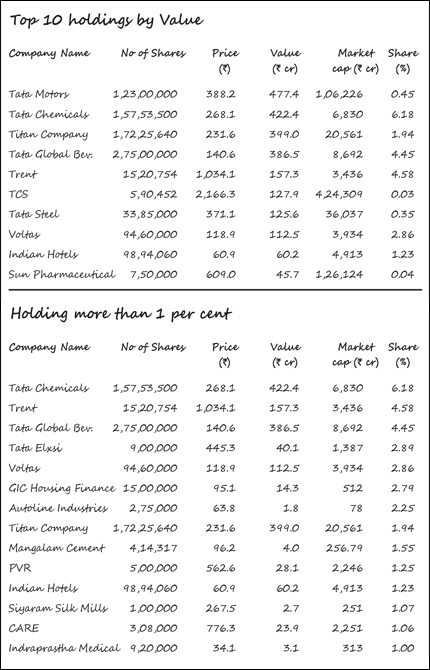

In all TIC has investments in 130 listed companies, a large many of them being Tata group companies. The market value of these investments add up to ₹3,422 crore or an NAV of ₹815 per share whereas TIC's share price is ₹411; a 50 per cent discount. If you are bullish on the Tata group companies and other underlying companies, then your investment in this stock will gain and you will also receive healthy dividends, which at 3.9 per cent is a cushion in a falling market.

Maharashtra Scooters

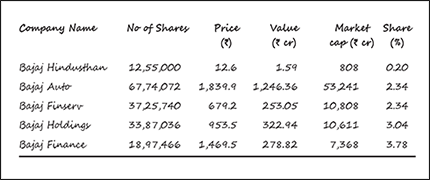

Maharastra Scooters (MSL) is jointly held by the Bajaj group and the Western Maharashtra Development Corporation (WMDC). MSL used to manufacture scooters for Bajaj, which it stopped doing from 2006. Now the company manufactures some components for Bajaj Auto but the major portion of its earnings is in the form of dividends from its underlying investment in five Bajaj companies. Huge discount to its underlying assets and high dividend yield of 4.7 per cent can be a fruitful investment in the long run. Bonanza value unlocking can come if Bajaj buys WMDC's stake which it has been trying for since 2004.