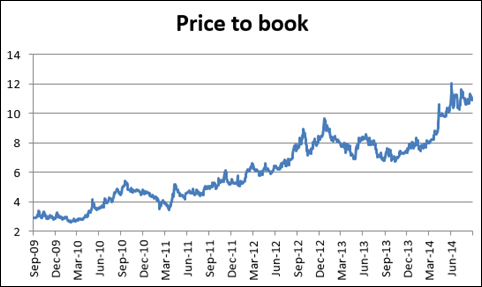

Gruh Finance has always been on our radar. We first recommended this stock in April 2013 and we reiterated our view last month in the anniversary issue with Gruh as a future proof stock. Since April 2013, when we first recommended it in 2013 at the adjusted price of ₹108 it has almost doubled at the current price of ₹209 and has reached an extraordinary expensive valuation with price to book value of 10.94.

The company has a reputation for its credit policy and asset quality, but is this high a valuation justified? When we compare Gruh with other major players, the stock stands out with an exceptional price to book even as other housing finance companies are available at a much cheaper rate.

Yet, when we analyse the growth rate of its book value; it does not stand extraordinarily to command such a premium. So, what are investors paying for? The answer is simple; they are paying for the safety of asset quality and transparent management.

So, should you continue holding the stock with such a high level of valuation? Yes. If you have planned to hold the stock for next 10 years or more and those are young investors should hold it till retirement. But sell it to realize your gain if your investment horizon is short to medium term or your investment object is approaching because it is best time harvest it now.

| Company Name | Market cap (Rs cr) | PE | PB | Book Value CAGR-5Y |

| Can Fin Homes | 789 | 10.1 | 1.67486298181823 | 12.3 |

| Dewan Housing | 4690 | 8.4 | 1.26548182993434 | 29.2 |

| GIC Housing | 954 | 9.4 | 1.49494649293766 | 11.7 |

| Gruh Finance | 7549 | 39.9 | 10.942269725855 | 21.5 |

| HDFC | 166380 | 20.5 | 4.26352224700687 | 18.1 |

| Indiabulls Housing | 13188 | 8 | 2.15116242371981 | 47.4 |

| LIC Housing | 15763 | 11.9 | 2.00673060039227 | 24.3 |

| Repco Home | 2831 | 25.1 | 3.69701361859943 | 33 |