S&P BSE Sensex, which represents the most traded 30 stocks in the Bombay Stock Exchange, is synonym with the stock market. Most investors use it to track the daily movement of the sock market. However, a closer look at the performance of the 30 stocks that form the Sensex in the last six years -- post-2008 slowdown, to be precise -- reveals that all of them couldn't match the performance of the Sensex during this period.

In fact, 10 stocks have underperformed the Sensex during the period. (See table: How laggards fared?) Interestingly, the market heavyweight Reliance Industries underperformed the index every single year in the last six years. Companies like BHEL, Bharti Airtel, NTPC, ONGC and Sesa Sterlite couldn't surpass the Sensex in five out of the last six years. Hindalco, Tata Power and Tata Steel failed to beat the index in four out of six years. Ironically, not even a single stock managed to outdo the index consistently every year in the last six years.

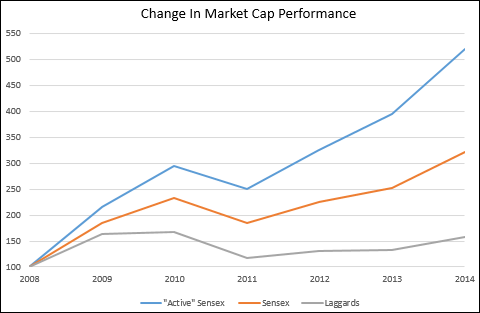

The market cap of the Sensex grew at 20.38 per cent annually during the last six years. So, what happens when you take the laggards out of the Sensex? With only 20 outperfomers, the Sensex's total market cap would have grown at an impressive rate of 31.63% annually, an astounding 1.55 times annually over the Sensex. With only the laggards, the market cap of the Sensex would have grown at a measly pace of 7.91% annually. If you take out the five lagging PSUs and Reliance Industries, the perennial laggard, the Sensex would have performed better. The market cap of the index would have grown at 27.31 per cent annually.

The analysis raises some interesting questions. One, does it really make sense to invest in an index which has 1/3rd of its constituents dragging it down for such a long period? Should you focus only on the winners?

How laggards fared?

| Laggards | CAGR (in%) |

| NTPC Ltd. | -0.0373 |

| Bharat Heavy Electricals Ltd. | -0.0045 |

| Bharti Airtel Ltd. | -0.0022 |

| Tata Power Company Ltd. | 0.0217 |

| Reliance Industries Ltd. | 0.0637 |

| Tata Steel Ltd. | 0.1071 |

| Oil & Natural Gas Corporation Ltd. | 0.1266 |

| GAIL (India) Ltd. | 0.1369 |

| State Bank Of India | 0.1588 |

| Sesa Sterlite Ltd. | 0.1649 |

| S&P BSE Sensex | 0.1907 |