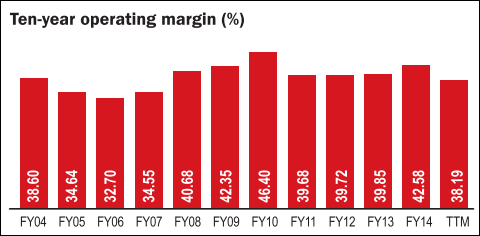

If there is one company that comes near the pharma sector leader Sun Pharma in profitability, it is Murali Divi's company. Divi's Laboratories has been one of the most consistent high-profitability companies you can find across sectors. Look at its ten-year average margins of close to 40 per cent. Not many companies can match that.

Profitability. Divi's margins have long been credited with the relationships that founder Murali K Divi has cultivated over the years with his customers. No other competitor has managed to command the same profitability manufacturing on contract and producing generics as Divi's has.

Outlook. Divi's has guided revenue growth of 18-20 per cent in FY16. It has five units at its DSN SEZ - all of them operating at high utilisation. That has the company scrambling to build additional capacity in Andhra Pradesh at an outlay of `500 crore; it is likely to be commissioned by FY17. If there is any concrete sign a company is doing well, look at the utilisation levels and whether it is building more capacity to fill customer requirements. Divi's checks that test. It has guided EBITDA margins of 36-37 per cent in FY16. That's on account of higher contribution from lower margin generics and increasing share of domestic sales.

Valuations. Most market analysts will tell you that the stock factors in all these factors. Yet, an ROCE of 35 per cent, dividend payout of 45 per cent and margins of 37 per cent are no ordinary business. The EPS is expected to grow at 20 per cent annually in the next two financial years. Divi's trades at 29 times earnings. Those investors looking for a high-quality business, this is your buy.