Symphony is the country's largest air-cooler manufacturer, with a market share of more than 50 per cent of the organised air-cooler market in the country.

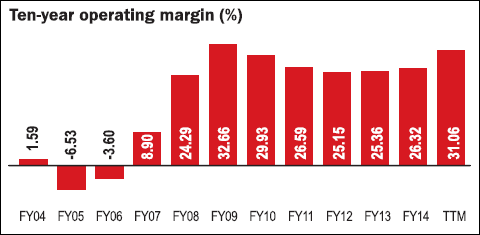

Profitability. Symphony's operating margins have averaged at close to 17.33 per cent in the last ten years. In the last twelve months, margins came in at a high of 31 per cent. The December 2014 quarter saw operating margins jump 478 basis points on decline in raw material, staff and other expenditure. Symphony outsources manufacture of air coolers to keep its cost overheads down. As a result, return ratios are high - the ROCE has averaged at 62 per cent in the last five years - all with nil debt financing.

Outlook. The company plans to take its product reach further with a planned distribution network of 40,000 dealers in the medium term - up from 16,500 plus dealers today. Symphony has kept ahead of the competition by continuous innovation. It has, over the years, introduced a slew of newer improved products that can take on any challenge. The growing middle class, likely to shift from unbranded air coolers, will find Symphony among its top picks. Symphony is likely to post annual revenue and earnings growth of 28 per cent and 33 per cent, respectively, says a report by ICICI Securities, between FY14 and FY17.

Valuations. Symphony has gained 270 per cent in the last 12 months. Even though the EPS has compounded at 27 per cent annually in the last three years, current valuations of 62 times earnings appear stretched. Valuations notwithstanding, Symphony is one company you should keep an eye out for when valuations cool down. The company has a dividend payout policy of 50 per cent.