Psychologists say that our behaviour is driven by 'recency'. We remember recent events better and those influence our emotions and decisions more. The period between 2009 and 2014, when the government was run by UPA II, was pretty bad.

During those five years, the global economy struggled with the aftermath of the subprime bubble. But India's entrepreneurial spirit was crippled by a combination of corruption and apathy. Policymakers and bureaucrats just forgot about trying to change things. Others focused on profiting from their positions.

So it felt like India was stuck in a time warp, with things going from bad to worse. The recency of those negative impressions makes it difficult to make an objective judgement about the last nine years, 2006-2015.

India has changed in many ways since 2006 and many of those changes have been for the better. There substantial growth over this long period. If we look at statistics such as telecom penetration, improvements in power supply, roads built, etc., there have been major improvements. There has even been significant wealth creation if we look at the stock market.

The pity of it is that so much more could have been done if our policymakers had been a little more honest and energetic.

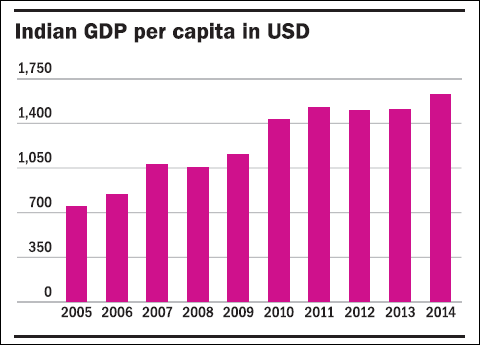

Given the recent recalculation of GDP, one can say how much the overall GDP has really grown. But one telling factor is that the economy did not grow much, if at all, in USD per capita terms, for several years.

So, while people saw a lift in income between 2006 and 2014, there was little improvement in income between 2011 and 2013. In real terms, given high inflation, many Indians were actually poorer by early 2014 than they had been in 2011.

That's where 'recency' is a behavioural explanation for the historic majority the BJP secured in 2014. By the time the 2014 General Elections came along, much of India 'felt' poor. People were sick and tired of a government that did nothing.

The Modi sarkar has said some of the right things since taking the oath in May 2014. It has made a beginning in terms of corruption reduction. But it has to do a lot more to clean up the mess it has inherited.

The biggest expectation, and the hardest to deliver upon, is employment generation. The Indian economy must grow fast enough to find employment for a workforce growing by roughly 12 million people per year. That implies creating around 10 lakh employment opportunities every month.

This employment-creation process will have to be 'back ended' because the BJP has to restart the investment cycle and clean up sundry issues. India is among the worst places in the world when it comes to the 'ease of doing business' because of insanely complex regulations and due to the endemic corruption. That red tape and corruption must be drastically reduced before the investment cycle will revive substantially.

There are also two major areas where massive legislative changes are required. One is labour laws; the other is land acquisition. Change in either area will be opposed tooth and nail by vested interests. The government has to find ways to get past this.

Some of the stated targets of the Modi government are unrealistic within the given time frames. For example, it is laudable that the GoI would like to deliver 24 × 7 power to every household by 2019. It is also very unlikely to happen.

Too many households - about 80 million - are still off the grid. The sector is run very inefficiently, and power companies owned by various states have huge and mounting losses. The power sector's accumulated losses are in the region of ₹3,00,000 crore and growing. Tariffs mean an average loss of about ₹1/unit generated. Again, this government has to find ways to stem those massive losses even before it finds the vast investments required to connect 80 million households to the grid.

Another much-quoted target - that of building 30 km of roads/day by 2017-18 - also looks unlikely to be achieved. UPA II was building about 10-11 km/day; the BJP has pushed that up to 14 km/day. Can it really double that and more in the next two years? The hundred-smart-cities initiative will also certainly miss the stated targets and schedules.

Nevertheless, there could, and should, be perceptible improvements in all these areas and other areas as well. Stalled projects across the infrastructure space have really scrambled growth and the government is trying to find ways to get those projects moving again.

The biggest chunk of bad debts is in the infrastructure space. This brings us to hard decisions about reforms in the banking sector. This is yet another area where the legacy of mismanagement is very toxic.

The GoI cannot realistically hope to meet the Basel III refinance targets, and clean up bad debts, within the stipulated time frames. It needs to provide ₹4,00,000 crore to recapitalise PSU banks and meet Basel III. To raise the capital, the GoI will have to dilute stakes down, below 50 per cent, in which case it would be taking the key decision of privatising public-sector banks. Or, the GoI will have to delay Basel III compliance, which has negative implications for capital inflows.

There is hope. This government is obviously trying to make necessary changes. But it is also following a consciously incremental approach rather than looking at big bangs. That steady approach might not be sufficient, given the sheer enormity of the task.

My guess would be that this government will miss many of its stated targets. But it will deliver enough to get things moving again and it will, perhaps, change the culture and mindset of endemic corruption. That, in itself, would be a good thing.

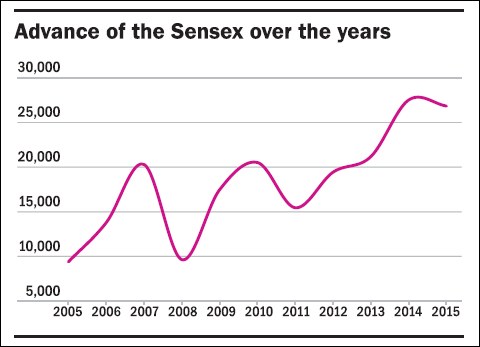

One interesting point: The stock market did pretty well through this period, which had one big bull market, one big bear market and another bull market which may still be running despite recent corrections.

In January 2006, the Sensex opened at 9,422, and it hit an all time high of 30,025 in 2015 before the recent correction pulled it back to 26,832. The CAGR is 11.6 per cent and that's ignoring the dividend yield, which averaged out at around 1.5 per cent per annum. Inflation across this period averaged out at around 5.2 per cent (if we take CAGR of the Wholesale Price Index from Jan 2006 to May 2015).

That suggests that the passive index returns beat inflation very comfortably. As always, there were lots of fluctuation and volatility. This return was only available to investors who could ride out those ups and downs for the long term, without overtrading.

Sadly, most Indian households don't participate in equity markets. Gross financial savings (GFS) of Indian households amount to 10.3 per cent of GDP, with physical assets (real estate and gold mainly) accounting for 14 per cent of GDP. Among GFS, bank deposits account for about 50 per cent while equity-related assets are just 4 per cent of GFS, or 0.4 per cent of GDP.

That low participatory rate for households in funding risk capital is also something that must change. The aam aadmi and aam aurat have to develop the confidence to put money into the stock market for the long term.

The writer is an independent financial analyst.

This column appeared in the July 2015 Issue of Wealth Insight.