The Altman Z-score is a widely used measure that applies an algorithm that has been found to have useful predictive value on the likelihood of a business going bankrupt.

Keep in mind that this is a likelihood and not a prediction. From a company's financials, it may look likely that bankruptcy looms, but the management may well succeed in improving matters.

However, for the thinking investor, it's wise to keep an eye on this number and have an insight into a company's solvency. You will find the score on our stock pages, under the Essential checks tab.

Here's a complete description of how the Altman Z-score works.

Z- score formula was developed by Edward Altman, Assistant Professor of Finance at New York University. First published in 1968, the score predicts a company's financial distress or the possibility of its going bankruptcy within two years. The score tries to predict probability of default by the companies due to the financial distress based on the current financial statistics of the company.

The Z-score formula for the manufacturing companies is:

Z = 1.2T1 + 1.4T2 + 3.3T3 + 0.6T4 + 1T5

Where:

T1 = Working Capital / Total Assets. (Measures liquid assets in relation to the size of the company)

T2 = Retained Earnings / Total Assets. (Measures profitability that reflects the company's age and earning power)

T3 = Earnings Before Interest and Taxes / Total Assets. (Measures operating efficiency apart from tax and leveraging factors. It recognizes operating earnings as being important to long-term viability.)

T4 = Market Value of Equity / Book Value of Total Liabilities. (Adds market dimension that can show up security price fluctuation as a possible red flag.)

T5 = Sales/ Total Assets. (Standard measure for total asset turnover)

While

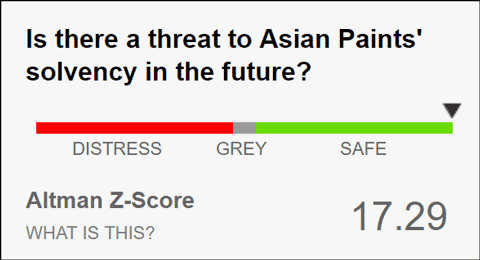

Z > 2.99 are considered in 'Safe' Zones

1.81 < Z < 2.99 are considered in 'Grey' Zones

Z < 1.81 are considered in the 'Distress' Zones

Z-score estimated for non-manufacturers companies is:

Z = 6.56T1 + 3.26T2 + 6.72T3 + 1.05T4

Where

T1 = Working Capital / Total Assets

T2 = Retained Earnings / Total Assets

T3 = Earnings Before Interest and Taxes / Total Assets

T4 = Market Value of Equity / Total Liabilities

While

Z > 2.6 are considered in 'Safe' Zone

1.1 < Z < 2.6 are considered in 'Grey' Zone

Z < 1.1 are considered in the 'Distress' Zone

Does the Altman Z-Score work?

As per Altman's study the average Z-score for the group of companies which bankrupted was -0.25 and for the non-bankrupt group was 4.48. And his test was found to be 72 per cent accurate in predicting bankruptcy two years before the event and 80-90 per cent accurate one before the event.

The Z Score is not intended to predict when a firm will actually file for legal bankruptcy. It is instead a measure of how closely a firm resembles other firms that have filed for bankruptcy, i.e., it tries to assess the likelihood of economic bankruptcy.