Axis Bank is one of the fastest-growing banking companies in India. It started as 'UTI Bank' in 1994 and was rechristened as 'Axis Bank' in 2007. The share price has gone up at an annualised rate of 26 per cent in the past ten years. ₹10,000 invested in the company are now worth ₹1,00,149.

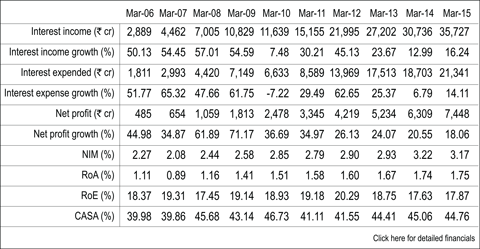

Axis Bank derives its strength from its low-cost operation; it has the industry's best cost-to-income ratio, 41 per cent. This has helped the bank generate one of the highest profit per employee in the industry, ₹18.16 lakh, and net interest margin, 3.8 per cent, as of FY15. Axis Bank's efficiency ratio, which is a non-interest expense, as per cent of total revenue is 43 per cent, which is the best in the banking sector.

Axis Bank derives its strength from its low-cost operation; it has the industry's best cost-to-income ratio, 41 per cent. This has helped the bank generate one of the highest profit per employee in the industry, ₹18.16 lakh, and net interest margin, 3.8 per cent, as of FY15. Axis Bank's efficiency ratio, which is a non-interest expense, as per cent of total revenue is 43 per cent, which is the best in the banking sector.

Despite fewer branches than HDFC Bank and SBI, Axis Bank has gathered higher deposits per branch, ₹125 crore per branch. Instead of opening new branches, the bank has focused on opening extension counters and has used agents to increase its business. The bank has also improved its non-interest income, which makes almost 20 per cent of the total income. It generates substantial income from transaction and merchant-banking activities.

Axis Bank is still growing its franchise and rolling out new products offerings like credit cards, loan syndication and remittance systems to further strengthen its non-interest fee-based income. The bank is not aiming at very aggressive growth but is going ahead with careful progression under Shikha Sharma, MD and CEO, who has the experience of working with ICICI Bank. Its provision coverage ratio of 78 per cent and capitalisation ratio of 15 per cent as per Basel III norm make it a safe bet and that too at an attractive valuation. Currently, the stock is trading at a price-to-book value of 2.56, which is a 6 per cent discount to its ten-year average of 2.72.