Led by Uday Kotak, the founder and MD, Kotak Mahindra Bank is one of the newest and fastest-growing private-sector banks in India. The stock has surged at an annualised rate of 31 per cent in the last ten years. ₹10,000 invested in the stock have now become ₹1,47,367.

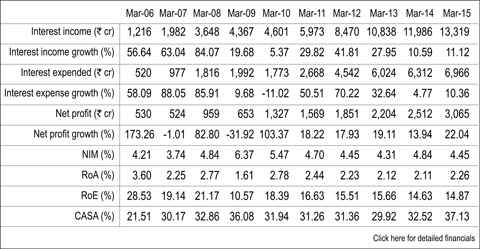

Although it was launched almost ten years after the first phase of rolling of private banks, yet it has been able to match the efficiency and margins of banks like HDFC Bank. It is the only bank to match the net interest margins of HDFC Bank, the industry leader, with a consistent ratio of more than 4 per cent. It offers the highest interest rate on its savings deposits and yet has managed to achieve a high-interest spread.

Although it was launched almost ten years after the first phase of rolling of private banks, yet it has been able to match the efficiency and margins of banks like HDFC Bank. It is the only bank to match the net interest margins of HDFC Bank, the industry leader, with a consistent ratio of more than 4 per cent. It offers the highest interest rate on its savings deposits and yet has managed to achieve a high-interest spread.

Kotak has achieved high growth and yet healthy asset quality due to its majority lending to non-salaried or self-employed customers, who are otherwise ignored and avoided by other private banks. By lending to these customers, who didn't find any other private lender, Kotak has been able to charge a premium. Although the segment has a riskier profile, the management has been able to formulate a better evaluation process, which has kept the NPAs low.

Moreover, Kotak has the highest non-interest income as per cent of revenue, which stands at 36 per cent; no other bank has been able to match it. This insulates it from the cyclicality of the interest income.

Kotak had a good presence in the north and west regions of India. With its recent takeover of ING Vysya Bank, it has managed to increase that presence in South India as well. For further growth and market penetration, the bank is now focusing on priority-sector lending. The current price to book value of 5.2 looks expensive as compared to other banks and is a 30 per cent premium to its ten-year average. Look out for better level in the future before buying the stock.