The calendar year 2015 saw growth moderating for Indian tech companies. Nasscom, the Indian technology industry association, has given a revenue guidance of 10-12 per cent for FY17. This story looks at the trends for the technology sector this year and the factors that can impact performance for the next financial year.

Moderating growth expectations: A common thread across key players, as they come out of Q3, is the moderation in growth expectations of client-IT budgets. Many tech companies have indicated that IT budgets could remain flat or even come down. Verticals that could feel the heat more than others include energy, utilities and telecom. In constant currency terms, however, performance is likely to be in line with that of 2015.

Verticals that will shine: Application maintenance and development, the primary revenue driver for most tech companies, is likely to continue to see weakness, while infrastructure management services are likely to drive revenue growth forward. US banks, a key revenue driver for banking, financial-services and insurance verticals of Indian tech companies reported in-line performance in their Q4 results. Most banks have reiterated their focus on digital banking, which should provide comfort to Indian tech companies.

The US will continue to drive revenues: The latest Q3 results point to the same pattern of revenue growth drivers. The US is expected to continue to drive revenue growth for tech companies while Europe is likely to see weakness.

Margin outlook: Near-term margin outlook is stable, given the lower utilisation levels in Q3. However, there are concerns on pricing pressure, going forward, for the sector.

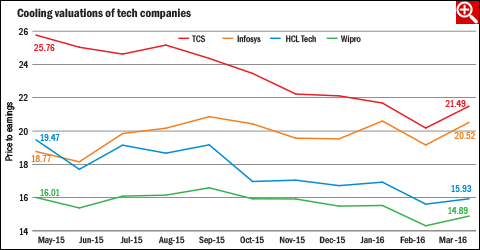

Attractive valuations: Here's the interesting part. Given the moderation in growth, top tech companies now trade at attractive valuations. TCS now trades below its five-year median price-to-earnings (P/E) multiple. Infosys trades at the median level. Wipro and HCL Tech both trade well below their median valuations. The graphic shows how valuations of top tech companies have cooled down over the past couple of quarters.