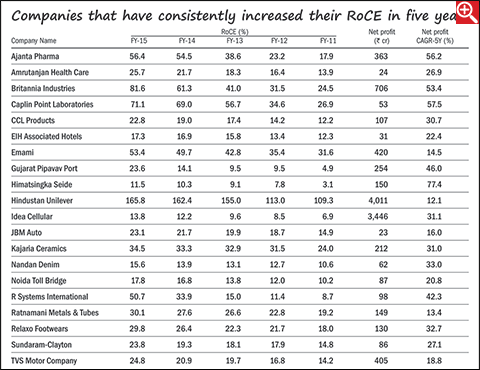

Return on capital employed (RoCE) is unarguably one of the most effective indicators of a company's profitability. It shows how much profit a company makes from its internal as well as external resources such as debt. If the RoCE has increased year on year, it means that the company has not only maintained its efficiency over the last year but has also put in additional effort to derive extra profitability from the resources available to it.

We bring to you the companies which have been able to increase their efficiency and have witnessed a consistent rise in the RoCE in the past five years. To keep a check on the earnings quality, we also ensured that the companies have positive cash flows from operations in the same five years. It is interesting to note that there are only 27 companies that fulfil both the parameters, an increasing RoCE and positive cash flows from operations for five years, in the universe of almost 4,000 listed companies. However, before investing in a company from this list, do perform due diligence on the qualitative aspects and valuation parameters of the company.