Yes, they can deliver blockbuster returns. But small-cap equity funds are also the riskiest category of funds you can acquire for your portfolio. So here are six checks to run before you take the plunge.

Returns over a cycle

It is not bull phases like we saw a couple of years ago that prove the mettle of a small-cap fund. It is the steep corrections like the ones in 2008, 2013 or even 2019. This calls for selecting your small-cap fund based on performance over an entire market cycle, usually seven-eight years. The top fund for one or three years can wilt if a correction hits. Apart from the trailing returns against the category or the benchmark, check out the fund's worst one-year show. A small-cap fund is only as good as its worst year.

Seasoned manager

Textbook investing, based only on numbers, doesn't work with Indian small caps. In this space, rogue managements, regulatory risks or a bad quarter can turn a stock from a market darling to an outcast in a blink. Given the qualitative inputs required to select stocks, it is best to entrust your small-cap bets to a seasoned fund manager. Check if the fund manager of your small-cap fund has been around for a decade and has managed this fund for five years at least.

In-house research

Success in small-cap investing doesn't come from hugging the benchmark. It is really about unearthing small firms that the market hasn't discovered yet. At the same time, it is essential that the manager doesn't fall for the 'spin' that surrounds fancied small caps in every bull market. This requires the fund house to have a seasoned in-house research team, a large coverage universe and the ability to put in the legwork. Thus, the small-cap opportunity is best played through fund houses with a ten-year record or those with sponsors who are steeped in equity markets.

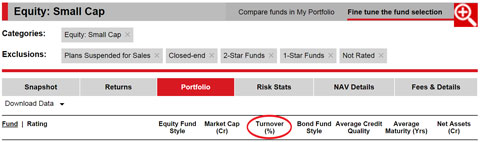

Portfolio turnover

In the small-cap space, making frequent wrong calls and unwinding those bets can cost investors dear by way of impact costs. What you need is a fund which is careful about what it buys and then has the conviction to hold on. That will reflect in low portfolio turnover ratios. The successful funds are the ones with turnover ratios of 50 per cent or less. You will find the turnover ratio in the Snapshot tab of any fund page. You can also find and compare the turnover ratio of multiple funds by using the Fund Selector tool (as shown below).

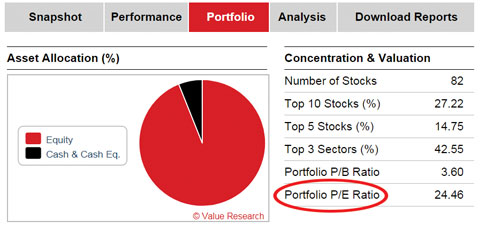

Portfolio P/E

The steeper the valuation the harder the fall. If your small-cap fund is a fan of high P/E stocks, it may be more vulnerable to earnings disappointments and nasty corrections. The average portfolio P/E of the fund (available under the Portfolio tab on the fund page as shown below) is a good check on whether your fund is overpaying for growth.

Mandate

A size of over R2,000 crore in today's circumstances can limit the manoeuvrability of a small-cap fund. Therefore, if the fund is this big, look for flexibility in its mandate to hold higher cash or invest selectively in mid-cap or large-cap stocks. Yes, this will dilute returns compared to pure small-cap funds. But then, you can't have the cake and eat it too!