With the global markets rallying, it sure seems to be a good time for equity investors. The 2008 recession is all but forgotten, the Brexit scare is already seeming distant and the people who bought the dips on all the scares of the past couple of years have done quite well for themselves. Equity investors are also most likely sitting on better-than-average gains and are likely quite concerned about whether they should convert their so-called 'paper profits' into some 'real money'. After all, what the market giveth, the market (could) taketh away. Is it a good time to exit the market?

Not really. As investor Mark Yusko puts it, "Winners press winners. Losers average losers." There is no necessity to sell something just because it has turned out to be a profitable investment.

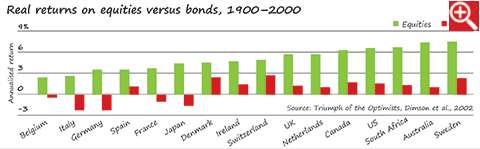

In a book named Triumph of the Optimists, the authors looked at equity returns over 101 years across 16 countries and concluded that in all the countries, equity returns handily beat bond returns (see the figure). Even more interesting, only two bond markets and one bill market performed better than even the worst-performing equity market. In other words, staying invested in equities through several market cycles created more wealth than owning 'safe' bonds.

One common argument against such studies is that they prove nothing as they are riddled with survivorship bias - the countries where the stock market itself collapsed or ceased to exist are excluded from the data, thus painting a rosy picture. While this is a valid concern, a 101-year track record of outperformance still makes the case for long-term equity investing.

The study also demonstrated that value stocks tend to outperform growth stocks in the long run. Growth stocks are highly popular, especially during bull markets, and it is hard to avoid the media hype surrounding growth companies. If you are a conservative investor, take heart. The data are on your side.

In bear markets, investors need confidence in their judgement in order to buy quality companies at attractive prices and hold on for better times. In bull markets, investors need to avoid the temptation to sell and get some 'real money'. Instead, they should ride their winners. The best way to do both is to have a longer time horizon when it comes to equity investing. While no one is going to buy and hold stocks for 101 years, the data are convincing that over long holding periods, investors in equities are well rewarded for staying in the market through ups and downs.