It's tough being a pharma company these days. Gone are the days of extra-normal growth, high profits and an easy USFDA. Many top companies are struggling to maintain even sales momentum. Here are a couple of things that have gone wrong for the sector in recent months.

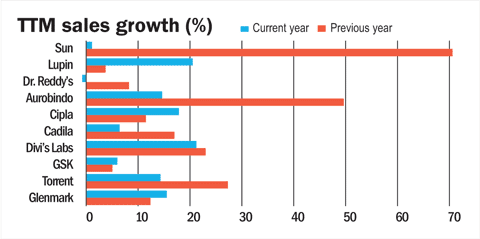

Stagnating revenue: For a long time, pharma was considered an evergreen industry. There was no way for pharma stocks to go but up. Medicines, it was surmised, were an essential requirement for billions. Today, the top ten pharma companies in the country (by market cap) are seeing revenue growth stagnate - from 14.7 per cent a year ago to 14.5 per cent in the last 12 months. Dr. Reddy's, Aurobindo Pharma, Cadila Healthcare and Torrent Pharma have seen revenue growth fall particularly hard in the last 12 months as compared to the previous year.

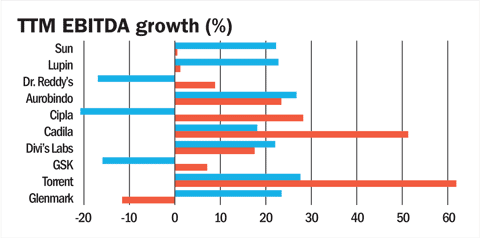

Losing money: Declining sales growth is just a harbinger of other problems. Five of the top ten pharma companies have seen their EBITDA growth decline. Top names like Dr. Reddy's, Cipla, Cadila and Torrent face this problem.

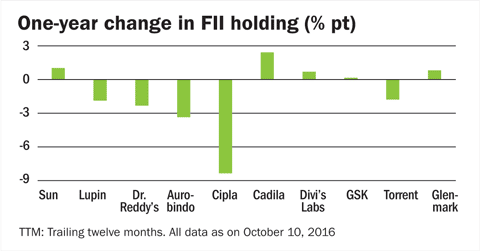

Declining FII interest: The not-so-attractive business environment has seen FIIs dump the sector. In companies where FIIs pruned their share, the aggregate holding declined by 2.3 per cent. Cipla, Aurobindo, Dr. Reddy's and Lupin are the top companies where FIIs drew their holdings down.

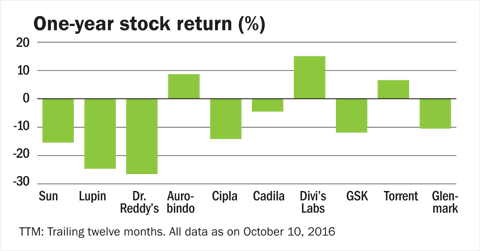

Falling returns: With market sentiment against the sector, it was inevitable that the sector would drag in terms of returns as well. The BSE Healthcare index has lost 10 per cent in the last one year. This aggregate hides greater losses made by the shareholders in Dr. Reddy's and Lupin, who have seen their investments shrink by close to 25 per cent.

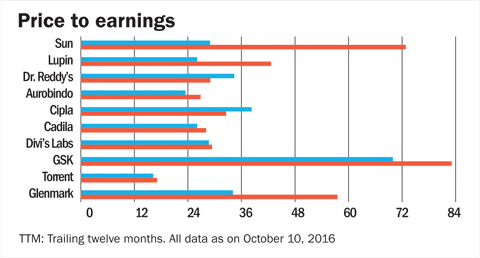

Cooling valuations: Perhaps the only positive fallout of this morass is that valuations of the sector have started cooling down. The BSE Healthcare index has seen its valuation fall from 43 times a year ago to 32 times today. If valuations cool down further, the sector will throw up compelling investment opportunities.