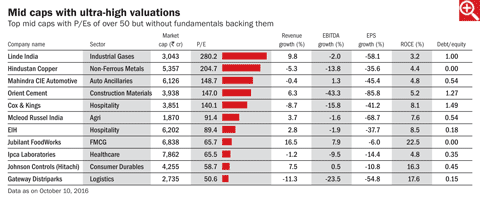

It's been a great year for mid caps. The BSE MidCap index has surged 33 per cent in the last six months. It's not uncommon now to find stocks with valuations hitting triple digits. Not all of these high-flyers though are backed by sound earnings growth. Let's take a look at some of them.

Linde India: Linde India, an industrial-gas supplier, is trading at a princely 308 times earnings. Over the last 12 months, it has seen its operating profit contract by 2 per cent, while revenue growth stood at close to 10 per cent. Linde is not a fast-money-earner either. Its operating profit compounded by 6.7 per cent in the five years ending 2015. Its investment in the Kalinganagar plant for Tata Steel is expected to improve performance going ahead. However, that does not justify its premium valuations.

Hindustan Copper: Another low-float stock, Hindustan Copper trades at close to 150 times its earnings. The company's fortunes depend upon international copper prices, which have risen slightly this year but not enough to justify its valuations. Hindustan Copper has also in recent months announced a new project in Chhattisgarh. In the last year, both revenue and operating profit declined by around 5 per cent and by 14 per cent, respectively.

Mahindra CIE Automotive: This automotive-component manufacturer trades at 144 times earnings. Mahindra CIE's operating profit grew by 1.3 per cent in the last 12 months. Both India and Europe revenues were down in the latest quarter results (March 2016). The company is undergoing a turnaround, definitive results of which could take some time to be visible. The market seems to be betting that Mahindra CIE will quickly turn its business around and turn into a high-quality business in the near term. That optimism still doesn't justify the expensive valuations.

Mcleod Russel: Mcleod Russel, India's largest tea producer, trades at 101 times. The company's operating profit actually declined in the last one year. Performance in the latest quarter (Q1FY17) was not inspiring either. Revenue was up sub-3 per cent. Volumes were marginally up, while the selling price was flat. Higher tea workers' wages and higher interest costs actually led to a net loss. With Kenyan tea supply up this year, price improvement could remain subdued hereon, making it difficult to see why Mcleod should trade at triple-digit valuations.

The above examples illustrate the folly of chasing market favourites. Without fundamentals backing them, most, if not all, stocks with lofty valuations eventually lose their steam. What then follows is painful experience for investors. Check whether a stock you are interested in has the numbers to back the premiums it is commanding and you should be safe.