For the longest time, PPF has been India's most favourite tax-saving avenue. It is a long-term savings instrument established by the Central Government. It offers tax benefits on contributions as well as withdrawals after the lock-in period. This scheme came into force on July 1, 1968, and is backed by the government with the objective of providing old-age income security to the self-employed and those working in the unorganised sector.

Every year the Government let us set aside some money into the PPF to save tax and a lot of people do so dutifully and gladly like a ritual. But they tend to overlook another tax saving option at their disposal - ELSS (Equity-Linked Savings Scheme). Mutual fund companies in India operate a set of mutual funds that qualify as ELSS funds as defined by the government. When you invest in these funds, your investment amount of upto Rs 1.5 lakh in a financial year can be deducted from your taxable income just like PPF.

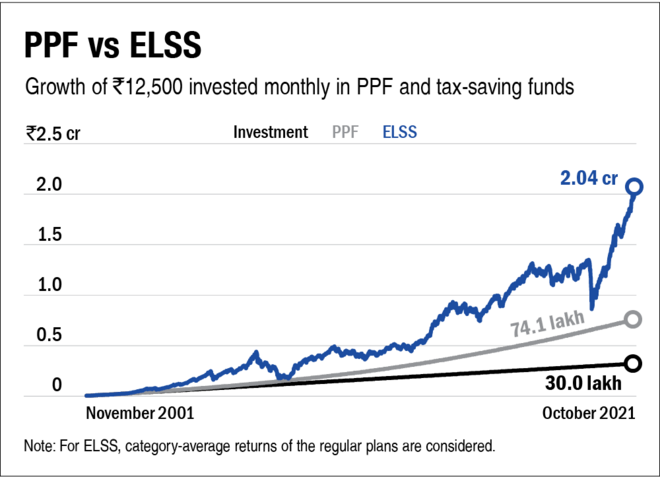

So what would have happened if you'd invested money in ELSS instead of PPF all these years? We put this question to test by analysing last 20 years of data, ranging from 2001 to 2021. We analysed PPF against ELSS and the picture it has revealed is indeed an eye-opener for many.

We considered Rs 12,500 investment every month (i.e. Rs 1.5 lakh every year) each in PPF and ELSS (making the total invested amount of Rs 30 lakh in each), starting in 2001 and ending in 2021. For the sake of parity, we took the average returns of the ELSS category and actual PPF returns during this period.

The corpus amount in PPF came out to be around Rs 74 lakh, while investment in ELSS fund would've added up to a whopping Rs. 2 crore, 2.75 times higher! The post-tax returns on ELSS would be slightly lesser but they would still handsomely beat PPF returns.

Besides this, ELSS funds have another hidden benefit. It makes for an excellent gateway product for beginner investors, giving them their first taste of equity investing and of mutual funds. You end up investing in these funds because the tax-savings attracts you and it has the shortest lock-in. However, the three year lock-in ensures (most of the time) that investors get good returns even if their timing and choice of funds is less than optimal. This experience converts a certain proportion of these investors to lifelong investors in equity mutual funds over and above their tax-saving needs. Once you have a taste of long-term equity returns, then you feel inclined to giving other types of equity investments a go as well.

A good tax-saving investment must be an investment first and a tax-saver later. For most people the investment that would make the most sense is in an ELSS fund. This is because salary earners generally already have some of the permitted amount going into fixed income through PF deductions and to balance that, equity is best. So, it might not be a bad idea to get out of your comfort zone and explore the ELSS route, even if partly to start with.