NPAs or non-performing assets of a bank are those accounts where loan payments have not been made for 90 days. There are two types of NPA ratios widely discussed: gross NPA and net NPA. The total NPA amount as per cent of the loan book is called gross NPA (GNPA) ratio. The NPA amount for which no provision has been made as per cent of the loan book gives us the net NPA ratio.

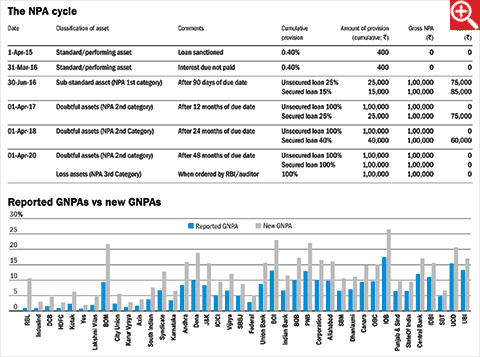

To make provisions and classify loans under gross and net NPAs, banks follow the NPA cycle. In the table below, the loan amount considered is Rs 1 lakh, with annual interest payments. The interest amount due on March 31, 2016, remains unpaid. We have ignored interest accumulation for provision calculation.

Given the NPA cycle, it generally takes around five years for a standard asset to turn bad. Hence, we should compare banks' current GNPAs with their loan books five years ago and not with their current loan books, which is currently the industry practice. The figure below shows banks with their new GNPAs (based on the loan books five years ago) against the reported ones. The new GNPAs are higher than the reported ones in all of the banks. This shows that the NPA problem is more serious than what it seems if things are put in perspective.