A bank's loan book signals its financial might. This is so because it is loan-book assets that generate interest for banks, and interest income is the bread and butter for banks. A high loan-book growth indicates fast-growing interest income.

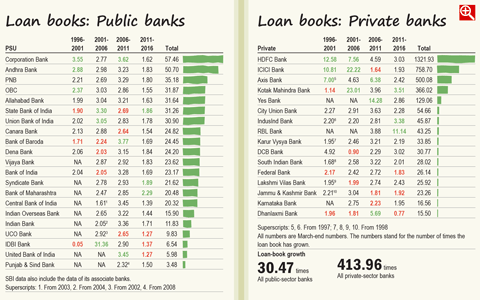

The tables show the loan-book growth of listed Indian banks in the public and the private sectors over 20 years. The 20-year time period has been divided into blocks of five years. The top-performing banks in a block of five years are highlighted in green; the worst-performing ones, in red. As can be observed, different banks have emerged at the top in different periods.

On comparing public-sector banks and private-sector banks, it is clear that the latter have outperformed the former in terms of loan-book growth. On the one hand, while public-sector banks have grown their loan books just 30.47 times in 20 years, private-sector ones have grown their loan books 413.96 times.

If you thought that the outperformance by private-sector banks is primarily due to a couple of banks that have performed exceptionally well - HDFC Bank, ICICI Bank, Axis Bank, Kotak Mahindra Bank and Yes Bank - wait! Even if you removed these banks from the sector, the loan books of the rest of the private-sector banks would have still grown 132.22 times, far ahead from the public-sector peers.

And how have the top public-sector and private-sector lenders performed in comparison to each other? In the last 20 years, the current largest private-sector bank HDFC Bank has increased its loan book from Rs 368 crore in 1996 to a mammoth Rs 4,87,290 crore in 2016 (1,321 times). The largest public-sector lender SBI has increased its loan book by only 31 times during the same period. Public-sector banks, it looks like, have much ground to cover.