Savvy stock investors know that numbers tell only half the story. The subjective assessment of a company's potential matters just as much. Analysing a company by looking at its financial data is called quantitative analysis and analysing a company by forming a view about its business and management is called qualitative analysis.

Let's consider the management aspect. The performance of a company is a direct function of the competence of its management. A shady management can destroy shareholder wealth by engaging in unscrupulous activities. On the other hand, a competent management can sail a company through tough times. Companies with competent management are true wealth creators.

Many investors don't realise the importance of evaluating the management unless some crisis breaks out. But it should be done before investing in any company, crisis or no crisis. So how do you go about assessing a management's potential? Here are some pointers that can help:

Tenure of the key management:

How long has the key management been with the company? Good companies have experienced people on the management team who have been associated with the company for a long time.

Integrity of the management:

What is the general image of the management? Is it considered clean and competent? Or are there legal cases pending against it? Have the promoters ever been convicted?

Decision-making ability:

How have the decisions taken by the management played out? Has it come under fire due to some strategic move? If yes, why and what was done to solve the crisis?

Treatment of minority shareholders:

What is the management's attitude towards minority shareholders? Do its decisions negatively impact them? For instance, diluting equity by issuing fresh shares to fund frivolous expenditures shows lack of concern for small shareholders.

The holdings of big guys:

Mutual funds like to own shares in companies with competent management. If a company has little or no fund holding, it's likely that fund managers don't trust the management's abilities.

Levels of pledged shares:

Pledging of shares is a practice by which promoters take a loan against their shares in a company. A high level of promoter pledging is alarming as it signals a deteriorating financial condition. In extreme cases, a promoter may even lose control of his company.

The various disclosures that listed companies have to make to the stock exchanges contain information about key management decisions. Do make use of them. The Value Research website also features ample management-related information.

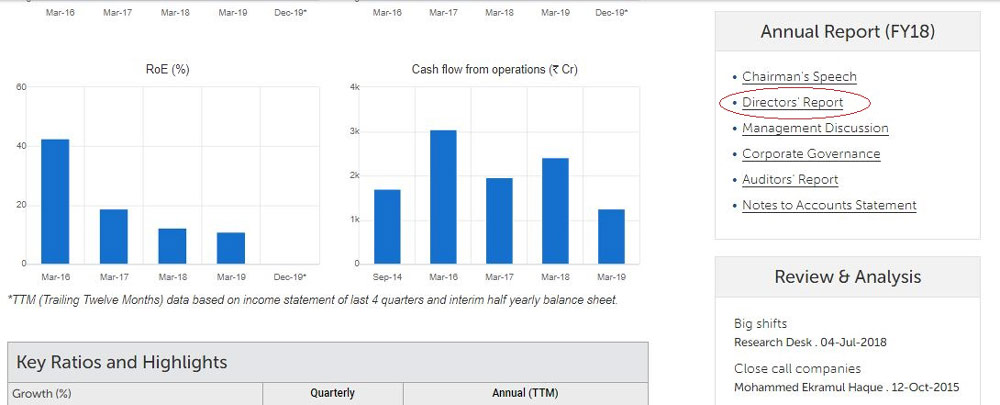

Just go to any stock page and scroll down on the Snapshot tab, and click on the Directors Report under the Annual Report (shown below).