The Indian stock market is soaring. The total market capitalisation of all the companies listed on the BSE has reached record highs. In dollar terms, it is set to cross two trillion dollars for the first time. But wait before you feel too excited about this number! While calculating the total market capitalisation, one should be aware of the problem of 'double counting'. What's that? Double counting in market-cap calculations means that for some companies, the market cap gets counted twice. This error in reporting market-cap numbers is worldwide in nature.

Why does double counting happen? When a company (the investor) has a subsidiary, an associate company or investments in another listed company (the investee), then the market cap gets counted twice. The investee company's value is also reflected in the value of the investor company. This reflection is often not full but most of the investment value is reflected in the market cap of the investor or the holding company. For example, Bharti Airtel's market value also reflects the value of its 73.5 per cent holding in its subsidiary Bharti Infratel.

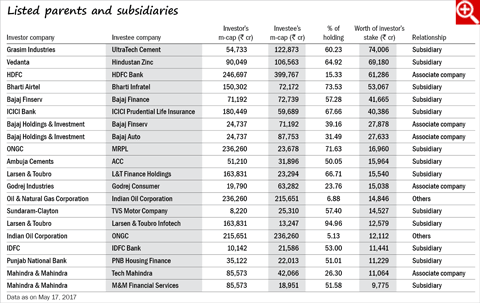

The value of the proportionate holding in the investee companies as per the data compiled by us comes close to as large as Rs 9.1 lakh crore as on May 17, 2017. This is around 7 per cent of the total market cap of Rs 128 lakh crore of the companies listed on the BSE. The table lists the companies where such an overlap is highest.

This column appeared in the June 2017 issue of Wealth Insight.