RBI has just released the Report of its Household Finance Committee and here are a few key findings from the same.

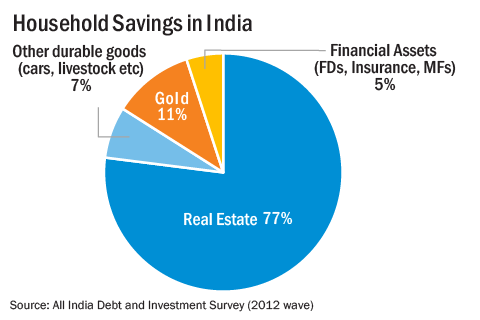

India household allocate 77% of their savings to real estate. This stands in stark contrast to the USA (44%) and Germany(37%). The love affair with real estate exists at all levels of the income pyramid. At the bottom end of the income distribution 60% of Indian households have real estate compared to 1% in the US and UK (think small farms and village homes). Apart from the usual suspects such as low education levels, black money and a clunky financial system, there is one more, hitherto overlook reason for our love of real estate - retirement.

The report points out that a large fraction of the wealth of young households in India is in the form of gold and durable goods (think vehicles, livestock, electronic appliances, etc.). This is also true of poorer households in general. As households grow older and richer they move away from these assets and into real estate rather than financial assets.

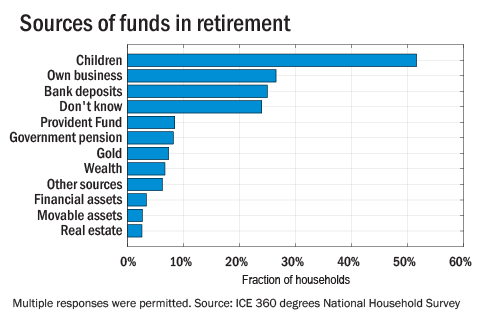

But what about post-retirement? Contrary to conventional wisdom, there is no significant reduction in real estate holdings of Indian households after retirement. In fact, the report forecasts that as Indian becomes both older and more prosperous, the relative share of real estate in household savings will increase - replacing gold and durables. The share of financial assets will remain constant. Why is this so? The answer lies in how Indian households plan for retirement. The graph below shows how Indian households expect to pay for retirement

It turns out that most Indians still rely on their children to bear the cost of their retirement. This is part of the reason why older people do not part with real estate. The report suggests that instead parents enter into an implicit contract with their children exchanging old age support for bequests of real estate. The near absence of financial alternatives like reverse mortgages leave them with few other choices.