Note: This article has no recommendation to either buy or avoid this IPO. Instead, we have presented all the relevant information based on which you can make your own decision.

One more note: As regular readers of our IPO analyses would have noticed, we do not approach insurance IPOs in the same format that we use for non-financial companies. The reason is that a large proportion of the questions are irrelevant to these companies. This is partly because of the tight nature of the regulatory environment they operate in, and partly due to the complex, long-term risks that they face. Investing in Indian insurance companies is still a novel activity, and there will likely be surprises ahead that neither analysts nor investors can predict at this point.

SBI Life Insurance is one of India’s largest ‘private’ life insurers in terms of new business premiums, second only to the publicly-owned behemoth LIC. We say ‘private’ because it is owned only indirectly, rather than directly by the State through the State Bank of India (SBI). It’s been around since 2001 and was launched as a joint venture between SBI and BNP Paribas (one of France’s largest banks). The company collected premiums worth Rs 21,000 crore in 2017. Its new business premiums grew at a 15% CAGR over the past 10 years (renewals grew at a whopping 40%).

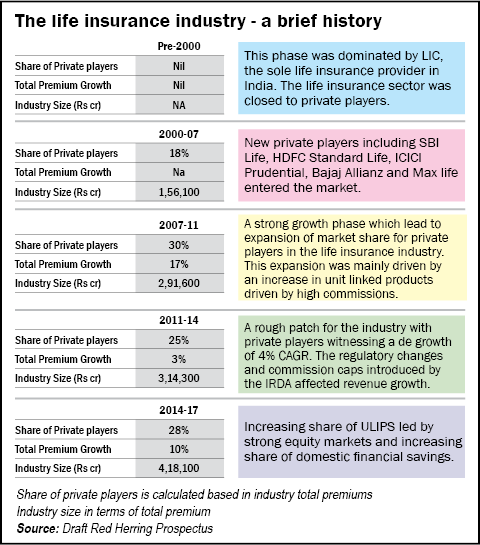

Before 2000, the life insurance business consisted of a single player - LIC (Life Insurance Corporation of India). The LIC still continues to dominate the market with a market share of 71% in new business premiums (premium generated by selling new policies excluding renewal premium). However, among the private insurers, SBI Life accounts for market share of 20% of new business premiums. It has the second largest assets under management in the private life insurance industry of Rs 97,700 crore.

What it does

SBI Life is in the business of insuring life. Life insurance companies generate their revenue from two sources:

- Net income generated from selling insurance policies

- Investment income generated out of funds invested

Their liabilities stem from life insurance payouts when people die, when regular payments under policies become due or when a pre-defined term in the policy comes to an end.

Life insurers typically write three types of policies:

Participating Policy: Where the payout is a combination of the guaranteed payment and a variable component linked to the insurer’s investment returns.

Non-participating policy: Where the payout is defined by the insurer beforehand.

ULIP: Where the payout is linked to the market with only a small guaranteed component.

Strengths

Promoted by India’s biggest bank

SBI Life Insurance is promoted by SBI which is the largest public sector bank in India. Its policies are actively sold in thousands of SBI branches around the country. In FY l7, the bank accounted for a whopping 41% of SBI Life’s new business premiums.

Pan-India presence

Unlike its private sector competitors who are focused on the big cities, SBI is spread across the length and breadth of India and so is SBI Life. As wealth is generated in the hinterlands, it will flow into the profit statements of SBI Life.

Cost-efficient

SBI Life has the lowest operating expense ratio of 7.8% (operating expenses as a percentage of premiums) in comparison to 10.5% and 12.2% for ICICI Prudential and HDFC Standard life respectively. In other words, it spends less money on its operations relative to its premiums.

Sticky

The persistency ratio tells us how many customers continue to pay premiums in subsequent years. At the end of 5 years, a significant 67% of SBI Life’s customers continue to pay premiums. This compares favourably to 57% and 56% for HDFC Standard life and ICICI Prudential life respectively.

Well-capitalized

SBI Life has solvency ratio of 2.04 times compared to the 1.5 times mandated by IRDA. The solvency ratio tests the solvency of the insurer in worst possible scenario - that all the insurance claims materialize at once.

Weaknesses

Regulatory changes

In 2010 IRDA capped product charges on ‘linked products,’ that is, ULIPs . This hit ‘private sector’ insurers hard. They saw negative growth in premiums from 2011-14 and their share of linked products fell from 71% in 2011 to 45% in 2014.

Tech Challenge

SBI Life may face a tough time if the industry moves from offline to online mode, a trend which has already started. Its SBI parentage is a drawback here since the public sector is typically slow when it comes to embracing innovation.

Royalty issues

SBI Life pays royalty income to SBI for using its logo as its trademark. The SBI brand name is very valuable for SBI Life. If SBI increases the royalty payout in the future or withholds usage of the brand name, SBI Life will suffer.

Cyclicality

ULIPs or Unit Linked Insurance Policies account for 79% of SBI Life’s new business premiums from individuals (and 50% of overall premiums). ULIPs by their very nature are tied to the performance of the stock market. This means that as markets rise, ULIP sales increase and vice versa. Thus an end of the current bull market is also likely to cause a slowdown in ULIP sales and hence SBI Life’s premiums.

Not cheap

Life insurance businesses are valued at their embedded value. This is the sum of net asset value and present value of future premiums (without assuming additional customers in the future). It is based on complex actuarial assumptions. SBI Life is priced at 4.23 times of its embedded value in comparison to 3.76 times for ICICI Prudential. The latter also has a better return on equity of 28.7% compared to the 18.6% offered by SBI Life in FY 17.

Should you buy?

Go through the positive and negative points we’ve highlighted before you make up your mind.

Who’s selling and how much

The IPO is wholly an offer for sale.

- SBI's stake will fall from 70.1% to 62.1%

- BNP Paribas stake will fall from 26% to 22%

- Amount to be raised: Rs 8400 crore

- Price Band: Rs 685- Rs 700