Debt fund managers, through active management of the portfolio, can deliver a better return than passive instruments like bank FDs if the market conditions are favourable.

To take a simple example, an investor who locked into SBI's fixed deposit five years ago would have received an annual interest of 9 per cent in the last five years on a pre-tax basis. Checking out the returns on debt mutual funds, we find that long-term gilt funds earned an impressive 9.76 per cent CAGR in these five years, credit-opportunities funds managed a 9.5 per cent CAGR and dynamic bond funds managed a 9.2 per cent CAGR - all doing better than the SBI FD. First-timer investors looking at these returns may feel that switching from bank FDs to debt funds is thus a black and white choice.

But before doing this, what they need to recognise is that these funds do not deliver returns like clockwork from year to year, like the bank FD.

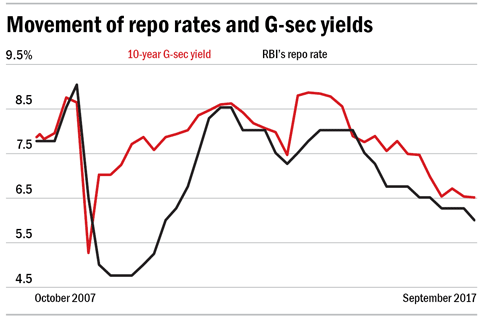

Take long-term gilt funds, the top-performing debt-fund category. The category returned 10.3 per cent in 2012, 3 per cent in 2013, 16.6 per cent in 2014, 6.7 per cent in 2015 and 15.6 per cent in 2016. On a year-to-date basis in 2017 (as of August 23), they managed 4.3 per cent. The big swings in the returns of long-term gilt funds are owing to the fact that such funds make most of their returns from falling interest rates. As long-term G-secs are the most price-sensitive category of bonds, funds which bet on them make the most gains when rates fall. But on the flip side, these funds also make the most losses when rates rise. The performance of long-term gilt funds, therefore, depends on how well the fund manager is able to read the direction of rates in the market.

Credit-opportunities funds may not see their returns swinging as sharply as long-term gilt funds from year to year. Returns for credit-opportunities funds hovered between 7.5 per cent and 11.6 per cent annually in the last five years. But as these funds earn higher returns by investing in lower-rated corporate bonds, their NAVs can suffer sudden jolts if a bond issuer defaults or delays repayment.

Dynamic bond funds use a combination of both long-dated bonds and lower-rated ones to bump up their returns. Their returns thus tend to be just as volatile as long-term gilt funds or credit-opportunities funds.

Returns on hybrid debt-oriented funds (funds which own 75-85 per cent debt and park the rest in equities) look even more tempting, with the past one- and three-year returns on these categories at 10-11 per cent. But returns from this class of funds can be even more volatile as the equity component in these funds can even deliver negative returns in a bad year. In the last five years, returns on conservative hybrid debt funds have swung between 1.8 and 17.2 per cent on an annual basis. Returns on aggressive debt-oriented funds (which features many MIPs) have fluctuated between 4 and 24 per cent!

What the above comparison tells you is that bank FDs (or post-office schemes) and mutual funds are wholly different animals. Bank FDs guarantee rock-steady returns from year to year, but you miss out on the opportunity to make more money from trading on rate movements or high-yield (and thus lower-rated) borrowers. Debt and hybrid funds make the most of such opportunities to earn you a higher return, but if their calls go wrong, the returns can be far lower than those from the bank FD in some years.