Reliance Nippon Life Asset Management is a joint venture between Reliance Capital and Nippon Life Insurance, which is one of the largest life insurance company in the world. It manages mutual fund schemes (Equity, Debt, Hybrid, Commodities and ETFs). It also provides managed account services which include portfolio management services, alternative investment funds, pension funds, offshore funds and advisory mandates. It is the third largest AMC (asset management company) in India with a market share of 11.4% and total AUM (assets under management) of Rs 3.6 lakh crore, including managed funds of Rs 1.5 lakh crore (as of June 30, 2017). Reliance Nippon has a network of 171 branches and about 58,000 distributors. It also manages 55 open-ended,174 close-ended and 16 ETF (Exchange Traded Funds) schemes. Its management fees and net profit have grown at a rate of 21% and 15% respectively during 2013-17.

The Trailbreaker

In the 1990s, there used to a small listed AMC which no longer exists. However, the industry conditions and the scale of this AMC is so different now, that for all practical purposes, this is the first IPO from a mutual fund company.

The MF industry

In India, mutual funds are a sunrise industry with a huge potential. For the entire industry, the last five years growth rate is 24% p.a. for assets under management, 20% for revenues and 23% for net profits as of March 31, 2017. On top of that, in Value Research's estimation, the industry as a whole has hit barely 10% of the total potential.

Moreover, although the industry is getting a huge new number of investors every year, an overwhelming potential of Indian savers are yet to wake up to mutual funds. This represents a large potential for growth. Mutual funds account for as low as 3% of total financial savings of Indian households.

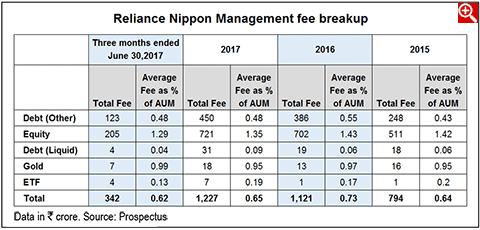

Management fee is the primary source of revenue for AMCs. It is the fee charged for managing investors' money and is charged, as well as regulated as a percentage of the assets. Market regulator SEBI has imposed a maximum cap on the fees which can be charged based on the asset class.

A unique feature of an AMC's revenue is its annuity-like nature. Once an investment is made, it keeps yielding the management fee as long as the investor does not redeem it. Long-lived assets keep making money for the AMC with very little attendant cost, for years and even decades.

Asset management is a concentrated industry with top 5 players (out of 41) accounting for 57% of industry as of June 30, 2017 and top 10 players accounting for more than 80% of AUM since 2015.

The table below highlights the total AUM of top 5 players in mutual fund industry excluding managed funds.

Strengths

The AUM size provides it with a big advantage. Bigger the size of AUM, higher the management fees and ability to sustain through downturns. As of June 30, 2017, it also commands 13.6% market share in the retail segment, which makes it the second largest retail player among all AMCs in India.

Weaknesses

Since 2008, Reliance Nippon has witnessed a steep fall in its market share in equity segment from a high of 18.7% in March 2009 to 10.9% as of September 30, 2017. None of its equity-oriented schemes features in the top five funds by AUM. Currently, the equity segment is led by SBI Mutual Fund with a market share of 12.7% (as of September 30, 2017). As per SEBI's ruling, AMCs can charge higher management fees for equity funds than debt funds. Therefore, a higher equity AUM yields higher profitability and thus commands higher valuations. Since March 2012, its equity segment has grown at a rate of 17% in comparison to a growth rate of 22% of total AUM, excluding managed funds till September 2017.

Who's selling and how much

Fresh Issue

Setting up new branches & relocating certain existing branches - Rs 38 Cr

Upgrading the IT system - Rs 41 Cr

Advertising - Rs 72777772 Cr

Lending to subsidiary (Reliance AIF) for new AIF schemes - Rs 125Cr

Investing in new mutual fund schemes - Rs 100 Cr

Funding inorganic growth and strategic initiatives - Rs 165 Cr

General Corporate Purposes - Rs 76 Cr

Offer for Sale

Nippon Life - Rs 642 Cr

Reliance Capital - Rs 283 Cr

Post issue, Nippon Life and Reliance Capital will hold 42.9% each.

Company / Business

1. Are the company's earnings before tax more than Rs 50 cr in the last 12 months?

Yes, its consolidated earnings before tax for FY 2017 were Rs 581 crores.

2. Will the company be able to scale up its business?

Yes, India's mutual fund AUM to GDP ratio stands at just 12% in comparison to the global average of 55%. Top 5 cities contributed about 72% of the average quarterly AUM of the mutual fund industry which leaves huge scope of expansion in two-tier cities. Increasing investor education, strong equity markets and drift towards lower interest rates trajectory will lead to further transfer of savings into financial savings.

3. Does the company have recognizable brand/s, truly valued by its customers?

Yes. However, although the Reliance brand name is very widely known, in personal finance, its association with positive values is not as strong as that of major competitors.

4. Does the company have high repeat customer usage?

Yes, a sharp increase in its new SIP account and increase in average ticket size of new SIPs indicate towards repeat customer usage.

5. Does the company have a credible moat?

Yes. Its size, brand and distribution reach do provide it with a moat. However, the mutual fund business, in general, is not conducive to building deep and long-lasting moats.

6. Is the company sufficiently robust to major regulatory or geopolitical risks?

No. Asset management business is highly regulated. Any major change in regulations can significantly impact the business. Any regulation change related to the cap on expense ratios or management fees can impact the profitability of the business to a large extent.

7. Is the business immune to easy replication by new players?

No, there are more than 40 AMCs in India. Asset-light model, low working capital requirements and no significant capital expenditures make this business easy to replicate.

8. Is the company's product able to withstand being easily substituted or outdated?

No. Practically identical mutual funds are available from almost all AMCs. Moreover, with the recent standardisation of fund types by SEBI, the existence of exact substitutes is practically guaranteed by regulation.

9. Are the customers devoid of significant bargaining power?

By regulation, this is not really applicable to the mutual fund business. All investors in a given fund must get the same NAV, and must be charged the same fees. Anything in the nature of bargaining is illegal.

10. Are the suppliers of the company devoid of significant bargaining power?

No. This is a pure service business. The major inputs for an AMC are employees' services and external services like registrar and transfer services, advertising, establishment costs etc. The bargaining power is varied.

11. Is the level of competition the company faces relatively low?

No, the level of competition in mutual fund industry is very high. The underperformance of any fund for a significant time can lead to redemptions and shift to other funds managed by competitors.

Management

12. Do any of the founders of the company still hold at least a 5% stake in the company? Or do promoters totally hold more than 25% stake in the company?

Yes, promoters of the company jointly hold more than 95% of the pre-offer equity capital which will fall to 85.7% post-IPO (Reliance Capital and Nippon Life holding 42.9% each).

13. Do the top three managers have more than 15 years of combined leadership at the company?

Yes, Sundeep Sikka (Executive Director and CEO) has been with the company since 2003, whereas the other two key managerial personnel are relatively new.

14. Is the management trustworthy? Is it transparent in its disclosures, which are consistent with Sebi guidelines?

Yes. While other parts of the Reliance ADA group is facing multiple business issues, the tightly-regulated and transparent nature of the asset management business makes this question moot.

15. Is the company free of litigation in court or with the regulator that casts doubts on the intention of the management?

Yes, but currently there is one material case against the company which involves a small amount and is currently pending. In the past, SEBI had issued warning letters to Reliance Capital related to findings in an inspection of books, irregularities in depository operations and records of Reliance Securities.

16. Is the company's accounting policy stable?

Yes, we have no reason to believe otherwise.

17. Is the company free of promoter pledging of its shares?

Yes. No promoter-holding is pledged.

Financials

18. Did the company generate current and five-year average return on equity of more than 15% and return on capital of more than 18%?

Yes, the company`s average five-year return on equity (ROE) and return on capital employed (ROCE) was 20% and 27% respectively. Its current ROE and ROCE stand at 22% and 31% respectively.

19. Was the company's operating cash-flow positive during the previous year and at least four out of the last five years?

Yes, the company had positive operating cash-flow in four out of last five years.

20. Did the company increase its revenue by 10% CAGR in the last four years?

Yes, its management fees increased at a rate of 21% during FY 13-17, driven by an increase in total AUM.

21.Is the company's net debt-to-equity ratio less than 1 or is its interest coverage ratio more than 2?

Yes, the company does not owe any debt.

22. Is the company free from reliance on huge working capital for day to day affairs?

Yes, the company's business is not working-capital intensive. Its working capital requirements are related to certain administrative expenses and salary of its employees.

23. Can the company run its business without relying on external funding in the next three years?

Yes, the company has healthy cash and cash equivalents which will add to the proceeds raised from IPO. Strong domestic inflows and increasing awareness towards SIP culture (systematic investment plans) will further cushion its funding requirements.

24. Have the company's short-term borrowings remained stable or declined (not increased by greater than 15%)?

Yes, the company has no short-term borrowing.

The Stock/Valuation

25. Does the stock offer operating earnings yield of more than 8% on its enterprise value?

No, it offers an operating earnings yield of 3.8% based on upper band.

26.Is the stock's price to earnings less than its peers' median level?

There are no suitable listed peers for Reliance Nippon. Based on upper price band, it will trade at a fully diluted post-IPO price to earnings of 39 times.

27. Is the stock's price to book value less than its peers' average level?

Based on upper price band, it will trade at a fully diluted post-IPO price to book of 6.8 times.

BRLM - JM Financial, CITIC CLSA, Nomura, Axis Capital, Edelweiss Financial Services, IIFL Holdings, SBI Capital Markets, Yes Securities

One or more of the authors may be applicants in this Initial Public Offering