Headquartered in Ahmedabad, Shalby Hospitals operates through a network of hospitals in India, as well as outpatient clinics (no overnight stay facility) and Shalby Arthroplasty Centre of Excellence or SACE (third-party shared surgery hospitals) located in India, Africa and the Middle East. The multi-specialty chain has 11 operational hospitals across five states, 47 outpatient clinics and 10 SACE. Hospitals usually provide four types of services: Primary, Secondary, Tertiary and Quaternary. Primary and secondary services are basic healthcare services, whereas Tertiary and Quaternary are advanced services, with the latter being a premium service. Shalby provides Tertiary and Quaternary services, with special focus on orthopaedics. It also provides services related to cardiology, neurology, oncology and renal transplantation.

As of June 30, 2017, Shalby had a total operational capacity of 841 beds. The company generated revenues of Rs 333 crore in FY17, which does not include the additional revenue contribution from new beds. Two new properties, Shalby Naroda and Shalby Surat, started providing inpatient services July 1 onwards, with combined bed capacity of 510. This will take the total operational capacity to 1,351 beds (an increase of about 60 per cent in the current bed capacity, assuming all the beds become operational). However, Shalby has a total capacity of 2,012 beds, which provides it with an opportunity to further scale its business. It also plans to open new hospitals in Nashik and Vadodara.

Industry outlook

The size of the Indian healthcare delivery market (hospitals) was estimated to be Rs 6.2 lakh crore in 2016. It grew at a 14-15 per cent CAGR during 2011-15, and is further expected to grow at 15-16 per cent during 2015-20 to Rs 11.7 lakh crore by 2020. In 2014, 12 per cent of the total population was above 54 years of age. The figure is expected to go up to 14 per cent by 2020, which will lead to an increase in demand for healthcare services. In 2015, nearly 23 per cent of the population was in the 45 and above age group, which accounted for nearly 95 per cent of joint replacement surgeries.

Industry-wide ethical issues

In recent weeks, we have had intense internal discussions on the ethical standards of the Indian private healthcare sector. None of our readers would be unaware--either through news or through personal experience--of the widespread incidence of malpractices in healthcare whereby hospitals are focussed solely on increasing revenue and profit without any regard for medical ethics. The recent Fortis case is only one of the very, very few that has come to widespread notice.

Here's a brief excerpt from the red herring prospectus (RHP) of this IPO. Please read it carefully. "As a significant portion of inpatient income is derived from medical services provided in the initial two to three days of an inpatient visit, we seek to increase our ARPOB (Average Revenue per Occupied Bed) by optimising the length of patient stay, increasing capacity turnover, focusing on complex procedures and achieving higher operating efficiency through the adoption of advanced technology and through the provision of improved medical services."

We believe that the investors should be mindful of the human impact of their investing decisions. To put it simply, you should consider whether you want to make money out of businesses that exploit human suffering. There are many ways of making money and you can certainly afford to let a few go by.

Please note that our commentary is not unique to this particular investment. You should think carefully before investing in the stock of any company that runs hospitals.

Strengths

Shalby specialises in orthopaedic treatments and has successfully performed 54,105 joint replacement surgeries since 2007. It had a market share of 15 per cent of all joint replacement surgeries conducted by private hospitals in India in 2016. It also specialises in Orthopaedic Surgeons' (OS) Needle and Zero Technique. OS Needle simplifies soft tissue procedures, thereby reducing the risk of infections as well as failures. Zero Technique involves a minimum incision (surgical cut), which also reduces the risk of infections as well as surgical time in total knee replacements.

Weaknesses

Shalby derives a major portion of its revenues from two hospitals, SG Shalby and Krishna Shalby, which collectively contributed about 77 per cent to its total revenues during FY17. Further, out of the 11 operational hospitals, six are located in Gujarat, which collectively contributed 80 per cent to the total revenues during FY17. Its occupancy rates were very low at 34.5 per cent during FY17. One of its oldest hospitals (Vijay Shalby) which began operations in 1994, had an occupancy rate of just 15 per cent during quarter ending June 30, 2017.

Concern

Shalby's promoter Vikram Shah has been charged with criminal cases related to complaints lodged by customers, even though no serious action has yet been taken against him. Any serious action against him can actually distort the image of company.

Where is the money going?

Fresh issue: Rs 480 crore

Towards payment of debt: Rs 300 crore

Purchase of medical equipment: Rs 64 crore

Purchase of interiors, furniture and allied infrastructure: Rs 11 crore

General corporate purposes: Rs 105 crore

Offer for sale: Rs 24.5-24.8 crore

Proceeds from IPO will go to the company's promoter Vikram Shah.

Additional details

Price band: Rs 245-248

IPO size: Rs 504-505 crore

Subscription dates: December 5-7

Post-IPO, promoter holding will fall from 97.8 to 79.6 per cent

Post-IPO, valuation will be Rs 2,644-2,670 crore

Revenue (FY17): Rs 333 crore

Profit after Tax (FY17): Rs 62.5 crore

Company/Business

1. Are the company's earnings before tax more than Rs 50 crore in the last 12 months?

Yes, its consolidated earnings before tax for FY17 were Rs 53 crore.

2. Will the company be able to scale up its business?

Yes, the increasing penetration of health insurance and demand for better healthcare facilities, and the bad state of government hospitals can translate into a huge opportunity to expand. The ageing population (23 per cent falls over the age of 45 years) and rising demand for orthopaedic services further adds to the opportunity.

3. Does the company have recognisable brand/s truly valued by its customers?

No, its brand name is not widely known given its concentrated presence in Ahmedabad and small scale of operations.

4. Does the company have high repeat customer usage?

Yes, orthopaedic treatment requires repeated session of physiotherapy, leading to repeated customer usage.

5. Does the company have a credible moat?

No, the company operates in a competitive environment with a lesser known brand, faces price-sensitive demand and low barriers to entry.

6. Is the company sufficiently robust to major regulatory or geopolitical risks?

No, the increased government scrutiny on private hospitals, speculations on imposing price caps and the recent public protests against private hospitals can significantly impact its operations.

7. Is the business of the company immune from easy replication by new players?

No, it can be replicated by new players like doctors. However, in the long run, reputation, brand name and expertise play a major role and as result, very few are able to survive.

8. Is the company's product able to withstand being easily substituted or outdated?

Yes, the demand for healthcare services will always grow. However, the patients will have choice of hospitals with varying levels of service and competence.

9. Are the customers of the company devoid of significant bargaining power?

No, given the kind of service they require and budget they have. Customers have choice to go to cheaper hospitals or government clinics.

10. Are the suppliers of the company devoid of significant bargaining power?

Yes, Shalby is not dependent on a particular supplier for medical equipments, which leaves the suppliers with limited or no bargaining power.

11. Is the level of competition the company faces relatively low?

No, the company faces high level of competition from public and private hospitals and other clinics.

Management

12. Do any of the founders still hold at least a five per cent stake in the company? Or do the promoters totally hold more than 25 per cent stake in the company?

Yes, the promoters currently hold 97.8 per cent of the pre-offer paid up equity capital, which will fall to 79.5 per cent of the post-offer paid up capital.

13. Do the top three managers have more than 15 years of combined leadership at the company?

Yes, Vikram Shah (Chairman and Managing Director) is associated with the company since its inception in 2004. Ravi Bhandari (CEO) is associated with the company since 2012.

14. Is the management trustworthy? Is it transparent in its disclosures, which are consistent with SEBI guidelines?

No, in FY13,14 and 15, the auditor issued a qualified opinion questioning the recoverability of loans made to the directors of a subsidiary company. The loans were not expected to be recovered and no provisions were made against them, leading to higher profits.

15. Is the company free of litigation in court or with the regulator that casts doubts on the intention of the management?

Yes. However, there is ongoing dispute as far as Shalby Jabalpur is concerned, which may lead to closure of the property. It was built on disputed land, which can only be used for providing educational services. There are also some other cases pending, but they are not expected to impact the company materially.

16. Is the company's accounting policy stable?

Yes. However, there was some change in estimated useful life of assets from FY 14-15 due to the adoption of Companies Act, which was applied prospectively.

17. Is the company free of promoter pledging of its shares?

Yes, no promoter holding is pledged.

Financial

18. Did the company generate current and five-year average return on equity of more than 15 per cent and return on capital of more than 18 per cent?

Yes, the company's average five-year ROE and ROCE were 22.5 and 21.4 per cent respectively. Current ROE and ROCE stand at 26.6 and 12.7 per cent respectively.

19. Was the company's operating cash flow positive during the previous year and at least four out of the last five years?

Yes, the company's operating cash flows were positive in all five years.

20. Did the company increase its revenue by 10 per cent CAGR in the last four years?

No, Shalby's sales increased at a rate of 9.6 per cent during the last four years.

21. Is the company's net debt-to-equity ratio less than one or is its interest coverage ratio more than two?

Yes, its current net debt-to-equity ratio stands at 1.1 on pre-IPO basis. But, due to use of IPO proceeds in reduction of debt, its net debt-to-equity ratio will stand at 0.15 times on post-IPO basis.

22. Is the company free from reliance on huge working capital for day to day affairs?

Yes, the company operates on a negative working capital mainly due to the presence of short-term borrowings and the current maturities of long-term debt. With expansion projects still in progress, it may continue to do so. It also operates on negative working capital cycle.

23. Can the company run its business without relying on external funding in the next three years?

No, the company has clearly stated that it will continue to finance its expansion plan with external funding in the coming years.

24. Have the company's short term borrowings remained stable or declined (not increased by greater than 15 per cent)?

No, the company is heavily reliant on short-term borrowings, which are increasing by more than 100 per cent year over year over the past two years.

Stock/Valuation

25. Does the stock offer operating earnings yield of more than eight per cent on its enterprise value?

No, it will offer operating earning yield of 1.8 per cent based on post-IPO fully diluted basis.

26. Is the stock's price-to-earnings less than its peers' median level?

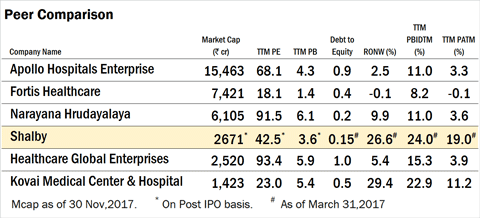

Yes, its post-IPO fully diluted P-E stands at 42.7 times in comparison to its peers' median of 44.6 times.

27. Is the stock's price-to-book value less than its peers' median level?

Yes, its post-IPO fully diluted price-to-book stands at 3.6 times in comparison to its peers' median of 5.6 times.

Lead Managers- Edelweiss Financial Services, IDFC Bank Limited and IIFL Holdings Limited