In response to fund houses launching multiple schemes in one category, which confused investors, market regulator SEBI has come up with a new system for fund classification. The new system aims to bring uniformity to the schemes launched by different fund houses, thus facilitating scheme comparison across fund houses.

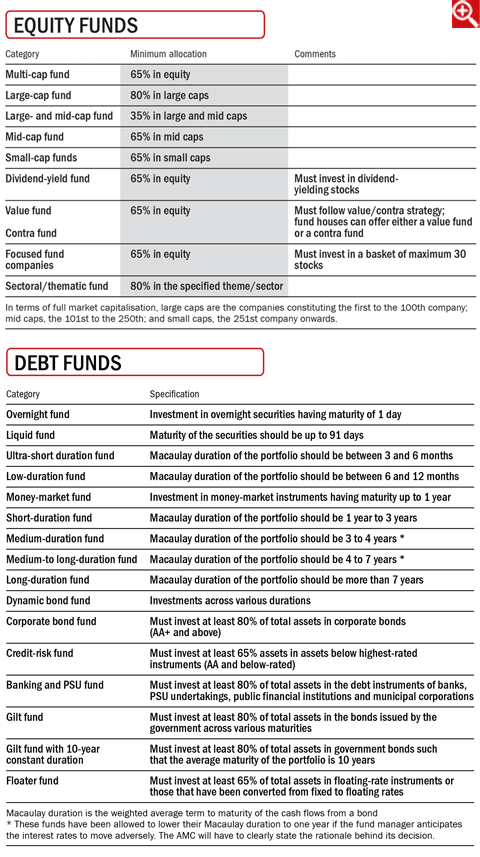

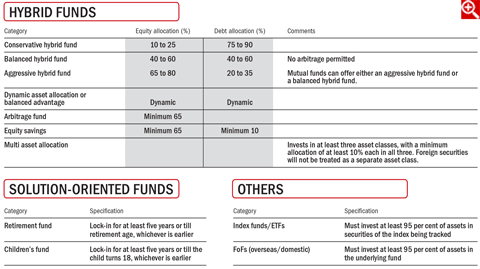

As per the new classification, all open-ended mutual fund schemes will be placed under the following categories:

- Equity

- Debt

- Hybrid

- Solution-oriented

- Others (index funds/ETFs/fund of funds)

Only one scheme per category would be permitted except index funds/ETFs, fund of funds and sectoral/thematic funds.

Fund houses have been asked to analyse their schemes and present proposals to SEBI by December 6, 2017.

In order to comply with the new classification, a fund house may have to merge or wind up some of its schemes or change their fundamental attributes. These changes will have to be done within three months after receiving SEBI's observations on the proposals.

The adjacent tables list the new categories of mutual funds. In all, there are 10 categories for equity funds, 16 for debt funds, six for hybrid funds and two each for solution-oriented and 'other'.