Assets managed by Value Funds have grown by an unprecedented 50 per cent to Rs 30,000 crore currently from Rs 20,000 crore a year ago. The sudden surge in growth of assets under management of mutual funds along with the upward movement of the market combined with a run-up in value stocks in the last couple of months has also resulted in growth in AUM of value funds.

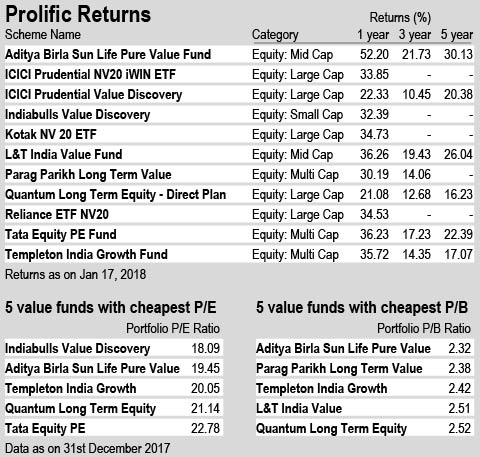

While Aditya Birla Sunlife Value Fund has grown by 52.20 per cent, L&T India Value Fund has grown by 36. 26 per cent, India Bulls Value Discovery Funds- Regular Plan has grown by 32.39 per cent in the last one year. Both the benchmark indices grew comparatively lower in the same time period-- while Sensex grew by 28.81 per cent, Nifty 50 grew by 28.47 per cent.

These funds have surpassed benchmark very impressively in the long term. During three and five year periods, Aditya Birla Sunlife Value Fund has grown by 21.73 and 30.13 respectively, ICICI Prudential Value Discovery Fund has grown by 10.45 and 20.38 respectively and L&T value fund has grown by 19.43 per cent and 26.04 per cent respectively.

The three value fund ETFs have grown by over 30 per cent during the past one year outdoing benchmark indices totally. In the past one year ICICI Prudential NV20 iWIN ETF has grown by 33.85 per cent, Kotak NV 20 ETF has grown by 34.73 per cent, Reliance ETF NV20 has grown by 34.53 per cent.

Valuation of value funds

For investors, understanding the portfolio of a fund is probably more important than merely looking at historical returns. Since value investing style gives more weight to valuations, let us look at the valuations of value fund portfolios. For every fund profile, Value Research gives details about the portfolio. The two valuation metrics given by us are Price to Earnings (P/E) and Price to Book (P/B). We should compare these values with respective numbers for Sensex. As on December 31, 2017, PE of the Sensex was 25.14 while PB was 3.06. During the same time, PE and PB of Aditya Birla Sun Life Pure Value Fund was 19.45 and 2.32 respectively. The PE and PB ratios of Indiabulls Value Discovery Fund was 18.09 and 2.86 respectively.

More about the funds

Value styled ETFs, like other passive investment vehicles, track the index. The ICICI Prudential NV20 iWIN ETF, Kotak NV 20 ETF and the Reliance ETF NV20 track the Nifty50 Value 20 Index, which has 20 stocks who according to the index manufacturer are 'value companies' forming a part of NIFTY 50 Index. Naturally, the ETFs in sync with the underlying index have huge exposure (10 to 15 per cent each) to Reliance Industries, ICICI Bank and Infosys Ltd. Then, comes Tata Consultancy Services, State Bank of India, Axis Bank, Hindustan Unilever where these ETFs hold 5 to 7 per cent each. The value index also has modest allocation to Bharti Airtel, Yes Bank and NTPC.

Let us now look at how actively managed value styled funds have positioned their portfolios.

One of the most popular funds in value category is the 13 year old ICICI Prudential Value Discovery Fund, which manages an AUM of Rs 1,7187 crore. The fund has generated about 23 per cent return year to date, under-performing broader markets by quite a bit. Fund manager Mrinal Singh doesn't find anything wrong with it. He reasons that when markets run ahead of the data, his value fund usually underperforms. His fund has big positions in Sun Pharmaceutical Industries, Wipro, and Infosys apart from exposure to L&T, HDFC Bank, NTPC, M&M, SBI and others in his 41 stock portfolio. The fund has shifted to large cap stocks. It has overweight positions in predominantly three sectors: technology, pharma and industrials.

Another popular scheme is the Rs 6,400 crore L&T India Value Fund, started in Jan 2010. The fund has a huge portfolio in terms of 79 stocks. Its current portfolio allocation is evenly distributed among giant and large-caps on one side (52%) and mid and small-caps (48%). Given the high number of stocks in its portfolio, no single stock has more than 4 per cent allocation. Its top holdings include RIL, HDFC, ITC, ICICI Bank, SBI, Divi's Lab, Federal Bank and Future Retail. The fund holds 5.5 per cent AUM in cash and cash equivalents.

Aditya Birla Sun Life Pure Value Fund is the best YTD performer among the value funds we have studied. With its over 53 per cent return, in fact this scheme is among the top 30 in the entire equity fund universe. For new investors, historical returns will not matter much. The fund, launched in 2008 and managed by Mahesh Patil and Milind Bafna, currently has about 88 per cent exposure to giant and large caps and about 11 per cent in mid caps. The 54 stock fund's top holdings include HPCL, Gujarat Alkalies, Tata Chemicals, GAIL, Tata Global Beverages, CPCL and Bata India. These are uncommon names compared to other value funds mentioned above. Clearly, the fund is bullish on select companies of chemicals, energy, engineering and construction sectors.

Parag Parikh Long Term Value Fund, launched in 2013, has created a following among investors. Its a differentiated offer in the sense that the fund's investment universe is not restricted by any self-imposed limitations in terms of sector, market capitalisation, geography, etc. The domestic portion of the scheme is managed by Rajeev Thakkar, while Raunak Onkar manages the foreign investment component. The fund has recently sold off shares of Apple, Anheuser Busch Inbev and Standard Chartered Plc. Its top three holdings are Alphabet (10.52%), Bajaj Holdings (7.26%) and HDFC Bank (7.24%). The top 10 equity holdings amount to 54.06 % of the core portfolio. These include two stocks listed overseas, viz. Alphabet (10.52%), Facebook (5.09%) and United Parcel Services (3.22%). As on November 30 2017, 65.59% was invested in Indian equities (including arbitrage positions) and 26.29% is invested in foreign equities. The residual 8.12% is parked in cash equivalents, CBLO, T-Bills and fixed deposits.

Another fund quite popular with retail investors is the Quantum Long Term Equity Fund - Direct Plan, launched way back in 2006. It has placed big bets on Bajaj Auto, Hero Motorcorp (automobiles), Infosys, TCS (technology), ICICI Bank, SBI (financials) and NTPC & GAIL (energy). In total, the fund has 22 stocks in its portfolio. Interestingly, 20 per cent of the fund assets are in collateralised Borrowing and Lending Obligation (cash and cash equivalents). Atul Kumar, who manages the fund since 2006, says: "Barring a few sectors, valuation of stocks seems to be at high levels. While share prices have run up, earning of companies haven't caught up. Cash level in our schemes remain higher than historic average, as there are very few buy ideas."

Lastly, Templeton India Growth Fund is the oldest value equity fund around. The scheme was launched in 1996. The fund currently has 52 per cent equity assets in giant and large caps, 39 per cent in mid caps and 9 per cent in small caps. Top 10 companies and sectors where the fund has invested as on November last year include Bajaj Holdings & Investment (diversified financials), Tata Chemicals (materials), ICICI Bank (banks/financials), JK Cement (materials), Tata Motors (Automobiles), HDFC Bank (banks/financials), Reliance Industries (energy), Apollo Tyres (automobiles & components), Yes Bank (banks/financials) and Tata Investment Corp. (diversified financials). It is a conservatively managed equity fund.

If you ignore the short-term performance, the longer-term trend of delivering excess returns is quite intact in case of value funds. About 88% of value funds (7 out of 8) have out-performed their stated benchmark in the 3-year period ended Dec. 22, 2017. Over the 5-year period, 7 out of 7 or 100% of value funds have surpassed benchmark returns, with the best ones actually delivering more than double the benchmark's gain in this period. This confirms that value investing works especially if you are long-term and returns can often be out-sized if one is patient.

If you ignore the short-term performance, the longer-term trend of delivering excess returns is quite intact in case of value funds. About 88% of value funds (7 out of 8) have out-performed their stated benchmark in the 3-year period ended Dec. 22, 2017. Over the 5-year period, 7 out of 7 or 100% of value funds have surpassed benchmark returns, with the best ones actually delivering more than double the benchmark's gain in this period. This confirms that value investing works especially if you are long-term and returns can often be out-sized if one is patient.

While fund managers want investors to look at consistency of returns, risks taken to deliver returns and stability of returns, experts feel the fund portfolio actually holds the mirror of what's going on in the fund. Simply put, the portfolio constituents and their respective weight determine fund returns.

Value styled ETFs, like other passive investment vehicles, track the index. The ICICI Prudential NV20 iWIN ETF, Kotak NV 20 ETF and the Reliance ETF NV20 track the Nifty50 Value 20 Index, which has 20 stocks who according to the index manufacturer are 'value companies' forming a part of NIFTY 50 Index. Naturally, the ETFs in sync with the underlying index have huge exposure (10-15% each) to Reliance Industries, ICICI Bank and Infosys Ltd. Then, comes Tata Consultancy Services, State Bank of India, Axis Bank, Hindustan Unilever where these ETFs hold 5-7% each. The value index also has modest allocation to Bharti Airtel, Yes Bank and NTPC.

Let us now look at how actively managed value styled funds have positioned their portfolios.

One of the most popular funds in value category is the 13-year old ICICI Prudential Value Discovery Fund, which manages an AUM of Rs 17187 crore. The fund has generated about 23% return year to date, under-performing broader markets by quite a bit. Fund manager Mrinal Singh doesn't find anything wrong with it. He reasons that when markets run ahead of the data, his value fund usually underperforms. His fund has big positions in Sun Pharmaceutical Industries, Wipro, and Infosys apart from exposure to L&T, HDFC Bank, NTPC, M&M, SBI and others in his 41-stock portfolio. The fund has shifted to large cap stocks. It has overweight positions in predominantly three sectors: technology, pharma and industrials.